When planning for retirement, understanding the differences between a Cash Balance Plan (CBP) and a 401(k) can be crucial for financial security. CBPs are defined benefit plans providing set payouts based on employment tenure and payout choices. For instance, a client with $100,000 in a CBP could opt for a lifetime annuity of roughly $8,500 annually or a lump-sum distribution of the full account. The investments within the CBP are managed by the employer or the investment manager appointed by the employer.

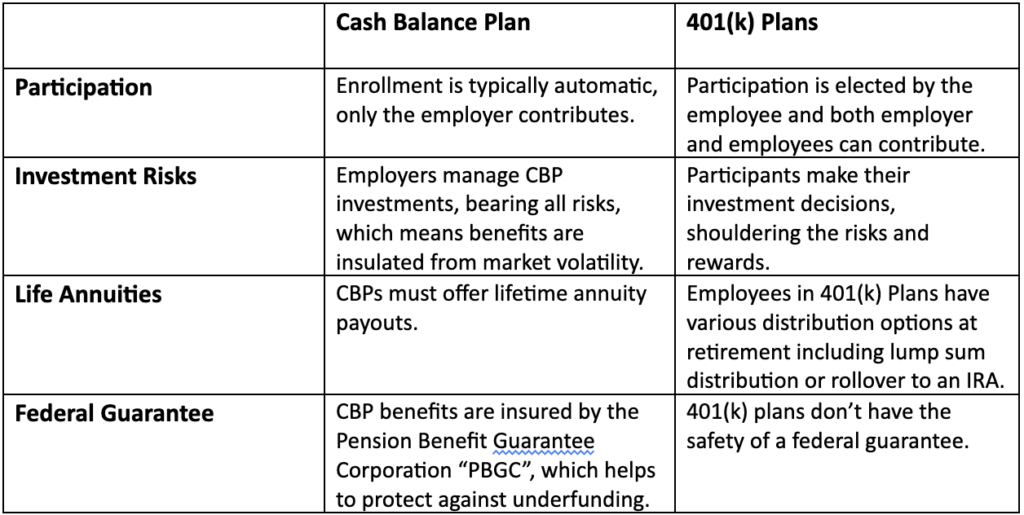

Here’s how CBPs stand apart from 401(k) plans:

In conclusion, CBPs tend to provide more employer-controlled, secure benefits. In contrast, 401(k) plans allow for greater individual control but come with increased risk for the employee. This fundamental difference can significantly impact retirement planning strategies and the security of retirement income. Connect with Capital Insight Partners today and learn how you are positioned for retirement.