As referenced in our Q3 2024 Mid-Year Investment Update, more citizens across the globe will participate in democratic elections than any previous point in history. It is of no surprise that the election cycle here in the US is longer than most developed nations in what feels like a constant campaign cycle.

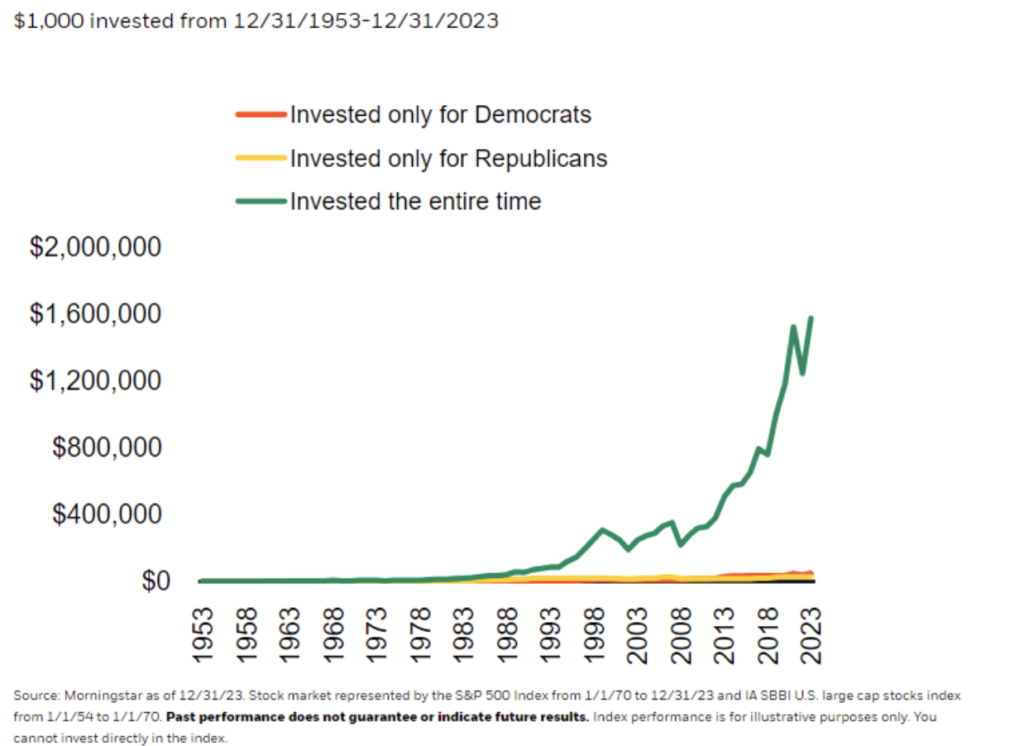

As we move ever closer to the primary election in November, we gathered a few resources from our colleagues to reinforce the notion that following our emotions when making investment decisions, especially based on our preferred political parties, traditionally does not translate into investment success. While it is critical to monitor and make long-term decisions based on policy change, maintaining focus on the disciplines where you can control the outcome such as savings and spending is a better usage of time.

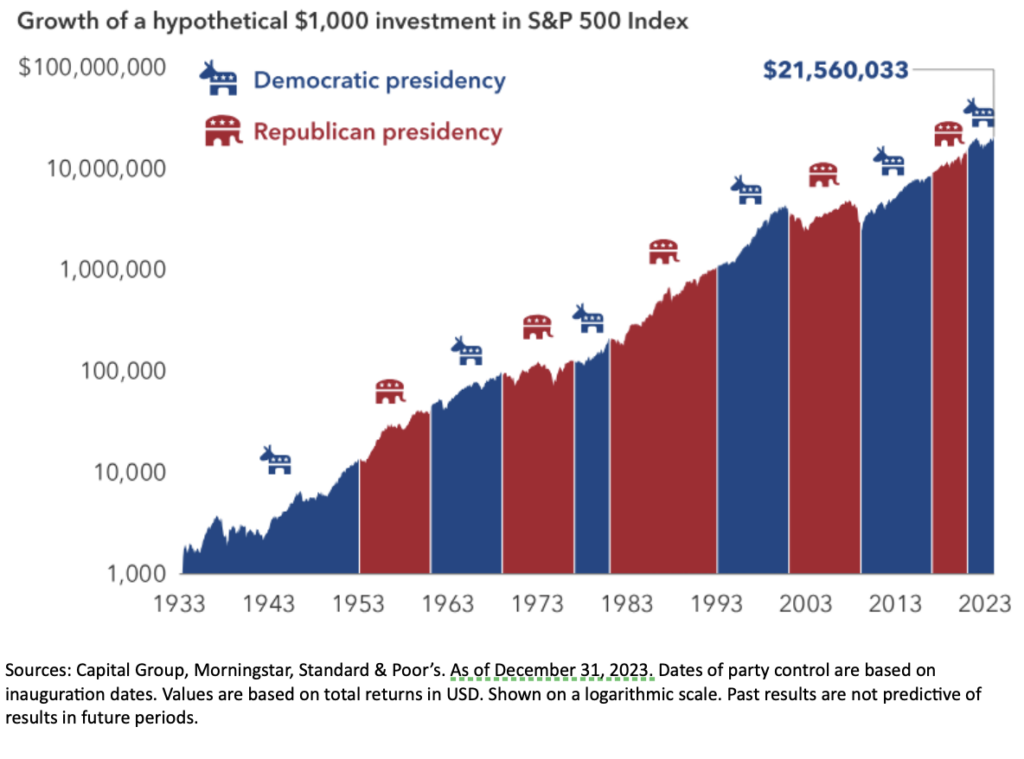

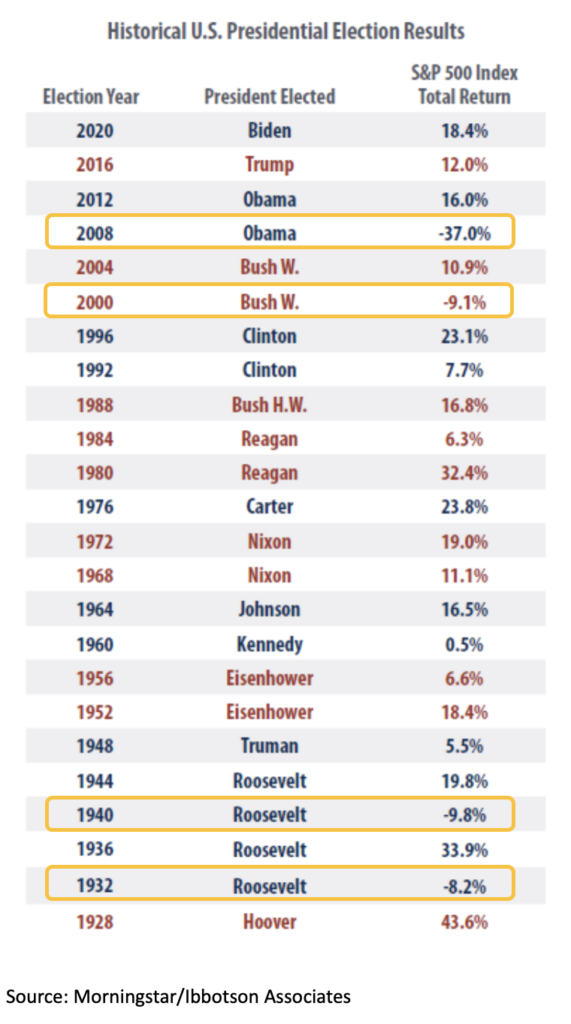

History suggests that the political party in the White House does not have much bearing on investment returns

3 mistakes investors make during election years. https://www.capitalgroup.com/individual/insights/articles/3-investor-mistakes-election-year.html

It’s not the political party, it’s the market

How the U.S. election may impact your portfolio

https://www.blackrock.com/us/financial-professionals/insights/investing-in-election-years

During an election year, red or blue in the White House has not been a good predictor of US stock market performance

First Trust Client Resource Kit | Election

https://www.ftportfolios.com/Commentary/Insights/2023/7/5/election-client-resource-kit—june-2023