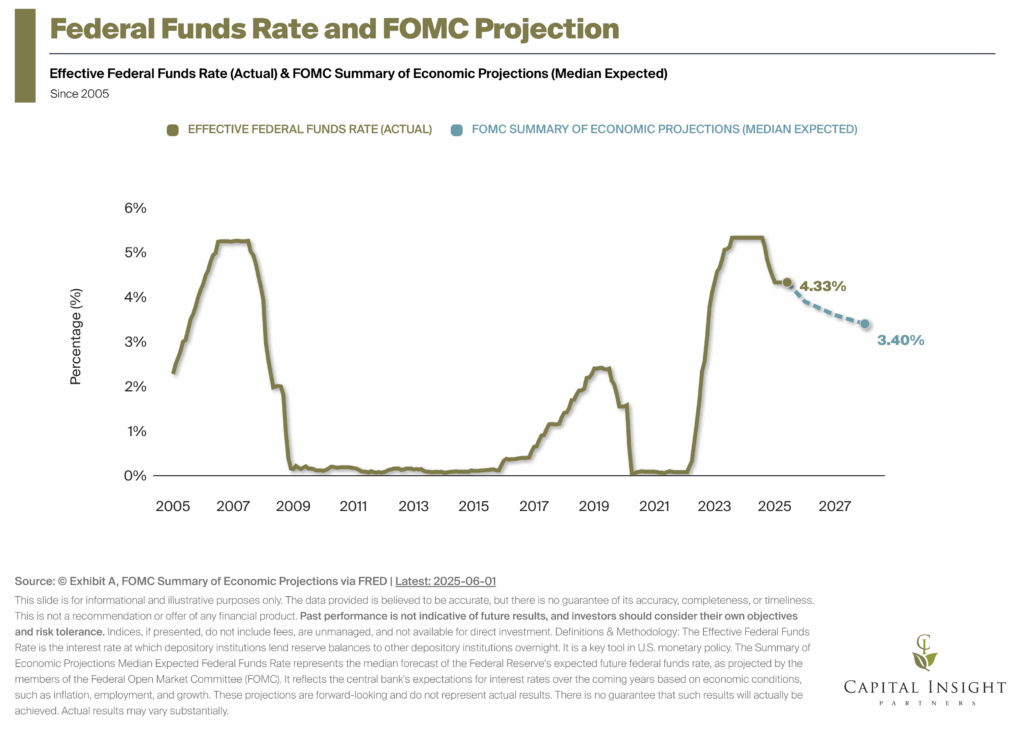

As of this writing, bond markets are pricing in two rate cuts by the Federal Reserve this year. The Fed has two mandated goals, stable prices (inflation of around 2%) and full employment (unemployment at about 4-5%). They are reasonably close to both goals at the moment, but the path forward could get tricky. As mentioned above, the labor market is healthy but softening. In addition, inflation has been more persistent than the Fed would like. Furthermore, tariff policy poses a risk that inflation ticks up. In our view, this is why the Fed has been slow to cut rates. We believe the cooling labor market may force their hand in the back half of the year and that the likely direction of U.S. interest rates over the next 12 months is downward. This should help consumer confidence, particularly in the housing sector. A growing economy, even if it is a slower growing one, and falling interest rates have historically been a positive backdrop for both stocks and bonds.