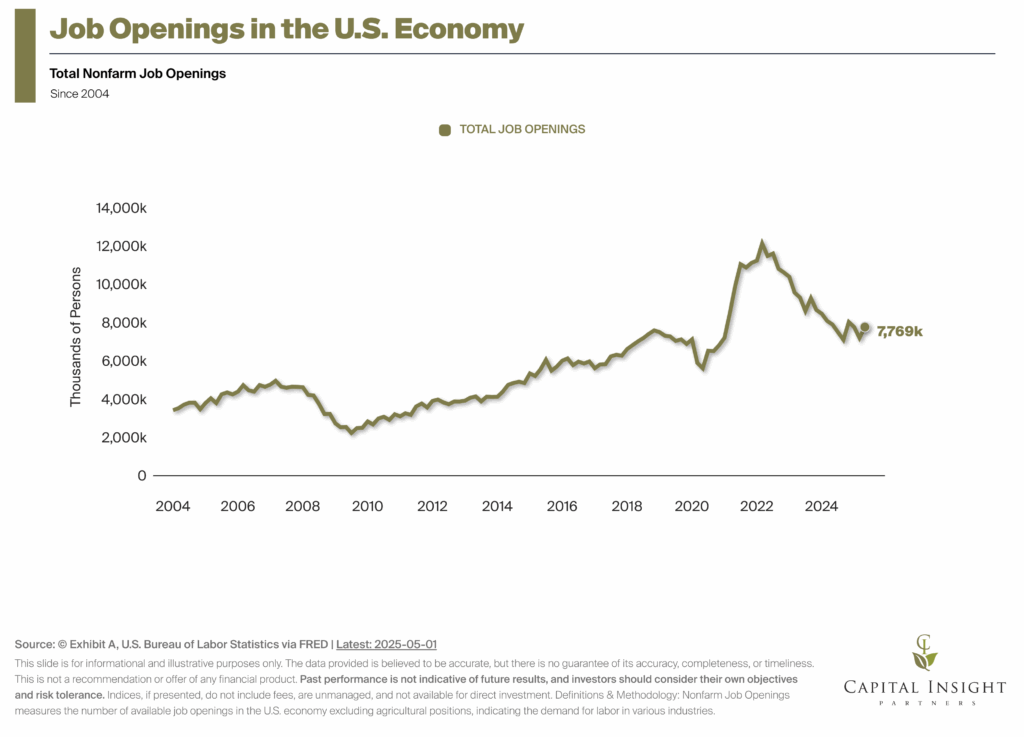

The U.S. economy has shown incredible resilience in the years following the Covid-19 pandemic. The primary driver of this has been the health of the U.S. consumer. Over that time, U.S. consumers have had very healthy balance sheets, and they have benefited from a strong labor market. This combination led to robust consumer spending and solid U.S. growth. Today, while the U.S. economy still appears to be in a healthy position, there are some data points that suggest things are slowing. Chart 4 illustrates one of them, total U.S. nonfarm job openings. The total level of job openings is pretty healthy at just over 7 million open jobs, which is about equal to the number of unemployed workers. This implies that the labor market is well balanced. That said, the trend in job openings is clearly down, indicating that it is getting harder and harder for unemployed workers to find a new job. Consumer spending makes up about 70% of the U.S. economy and there is plenty of research that shows consumers tend to spend more when jobs are plentiful and they feel secure in the jobs they have. It is this reason why a weaker labor market is worth paying attention to. It could lead to lower economic growth. We certainly don’t believe this is cause for panic, but it’s worth watching. The overall economy still looks like it is in a healthy position, but we are seeing things slowing down and we believe that means investors should maintain a well-diversified and higher quality portfolio.