In January, our panel discussed how the magnitude and sequence of the administration’s proposed policies would matter a great deal. The implementation of tariffs at varying degrees has brought a meaningful amount of uncertainty to the current environment, and with that, market movements up and down (otherwise known as volatility). Companies with higher valuations relative to the market tend to experience more price change than the average stock when volatility is elevated.

Despite the negative return year to date in major US indices, the average stock in the US market has positive returns to begin the year – a good reminder that it is a market of stocks, not a stock market. With earnings season upon us, we will start to glean insight from company management teams on the state of the consumer and how they are planning for the impacts of tariffs and other anticipated policies coming their way. A positive backdrop from earnings and company guidance may provide a buffer to the economic drag tariffs are imposing. Capital spending plans (investments made for future growth opportunities) tend to be decided by company’s management teams years in advance and may not slow considerably unless the economy and markets fall upon more challenging times.

While we still believe preferring US large cap companies over the long run will be appropriate within investment portfolios, we remain flexible in how we approach the path of getting there. We believe having a defensive position in portfolios is appropriate at this juncture, and returning to your long-term asset allocation targets (stock/bond/cash mix) is important as we continue to expect a choppy trading environment given the current risks that exist in the marketplace.

Should you have any questions, please reach out to your Relationship Manager for more information.

Investments may fluctuate in value. Investing involves risk including the possible loss of principal. Past performance does not guarantee future results.

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

1 GDPNow is not an official forecast of the Atlanta Fed. Rather, it is best viewed as a running estimate of real GDP growth based on available economic data for the current measured quarter. There are no subjective adjustments made to GDPNow—the estimate is based solely on the mathematical results of the model.

2 Magnificent 7 stocks include: Apple (AAPL), NVIDIA (NVDA), Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL/GOOG), Meta Platforms (META), Tesla (TSLA).

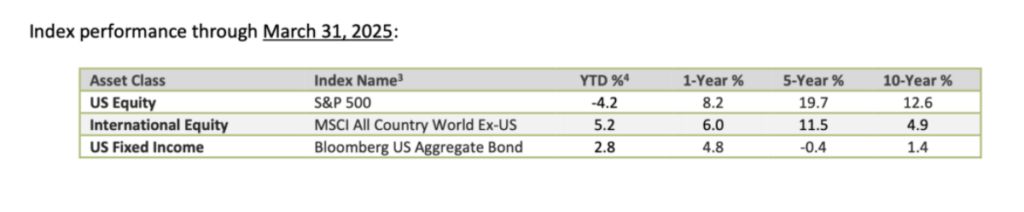

3 Index returns are for illustrative purposes only and do not represent actual performance of any investment. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. The Standard & Poor’s (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization U.S. stocks. The MSCI All Country (AC) World ex U.S. Index tracks global stock market performance that includes developed and emerging markets but excludes the U.S. The Bloomberg U.S. Aggregate Bond Index is a broad-based fixed-income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance

4 Index returns provided through Envestnet Tamarac, underlying data provider: Thomson Reuters.