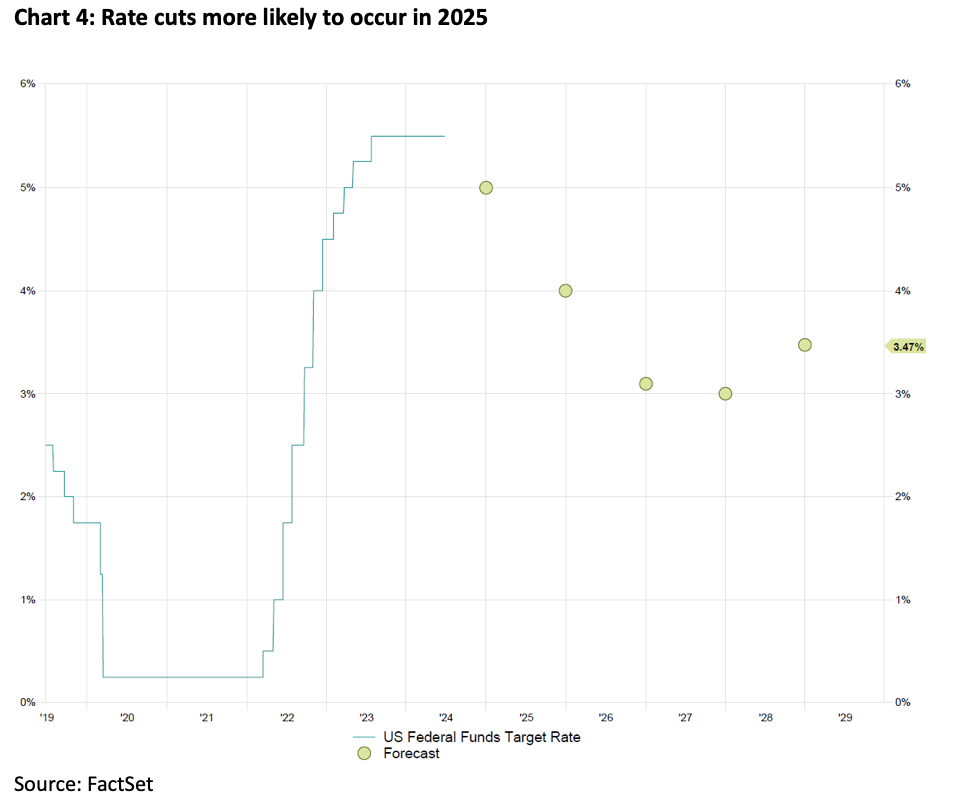

At the beginning of the year, the bond market was anticipating that the Federal Reserve would cut interest rates 4-6 times during 2024. Our general consensus as a team at the time was that we would see rate cuts, albeit fewer than the market was anticipating given the overall strength of the economy and US consumers. Fast forward to mid-year (having experienced no cuts at this point), the Fed’s current forecast is for just two interest rate cuts at 0.25% each, ending the year at a 5% Federal Funds Rate. While the visibility of future rate cuts remains unclear, one to two 0.25% rate decreases appears to better align with anticipated market conditions over the next 6-12 months.

Given the outlook for government yields, we believe it is appropriate for investors to look beyond treasuries for investment opportunities in fixed income.

Recently, where appropriate in client accounts given their investment objectives, we added exposure in the bond sleeve to Mortgage-Backed Securities. In addition, we exchanged our Emerging Market Bond position from local currency to US dollar denominated given the continued strength of the US dollar versus other currencies around the world. We are still neutral in bond maturities relative to the market, but believe there will be a time in the near future where it will be beneficial to extend and lengthen the average maturity of our bonds beyond the market average.

Investments may fluctuate in value. Investing involves risk including the possible loss of principal. Past performance does not guarantee future results.

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.