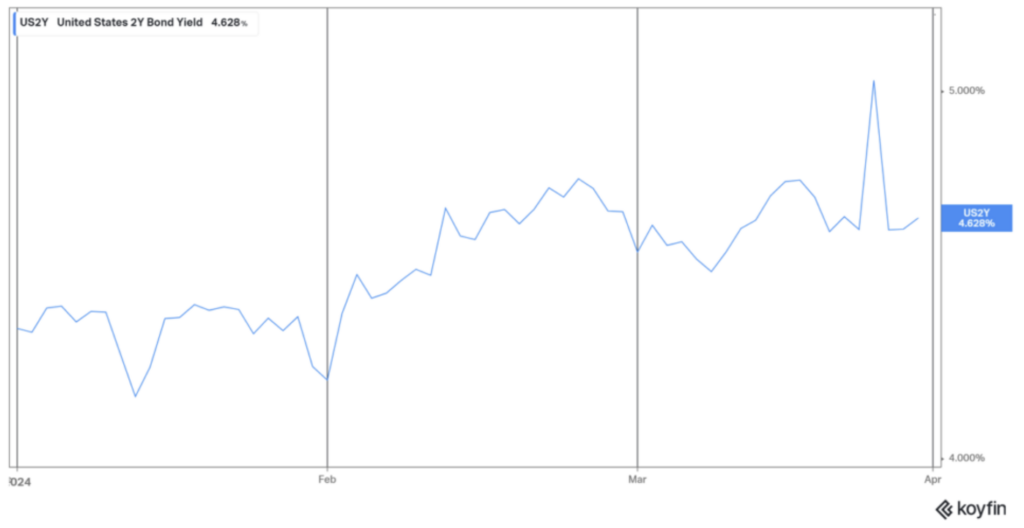

Returning to the Fed’s interest rate policy, if they proceed with interest rate cuts, bond investors will likely be rewarded. Interest rates on bonds, commonly referred to as yields, continue to reflect a potential rate cut by the Federal Reserve. Chart 3 below reflects the current yield on a 2-Year US Treasury Bond at approximately 4.6%. Said another way, the bond market is anticipating interest rates on 1-Year US Treasury Bonds one year from now to be 4.6%. From our starting point today, that would imply interest rate cuts over the next 12-months of approximately 0.75% from their current range of 5.25%-5.50% (current range minus 4.6%).

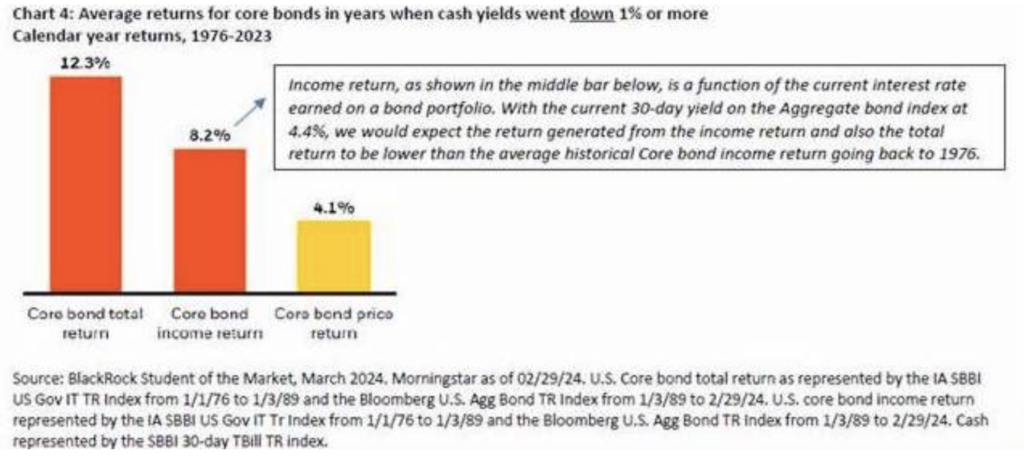

Traditionally, returns on bonds will perform well during periods of declining interest rates. As seen in Chart 4 below, the total return is comprised of two pieces: the interest income from the bond, and the potential increase in price of the investment. The higher interest yielding bond becomes more attractive to new investors as interest rates for similar investments in the market place are lower. For investors that have an allocation to bonds in their accounts, the increase in the weight of bonds in your accounts over the last couple of years has been in anticipation of this cycle.