Liz Ann Sonders, Chief Investment Strategist at Charles Schwab, periodically updates an article named ‘Panic Is Not a Strategy—Nor Is Greed’ originally written in 2008 (link at end). The basis of the article is to help remind investors to refocus on having a diversified investment strategy (even within an asset class like stocks) based on their risk tolerance and financial plan – in times of uncertainty AND optimism. Throughout time, there have been numerous studies of the power of this concept, and the third quarter of 2024 was a good reminder of this.

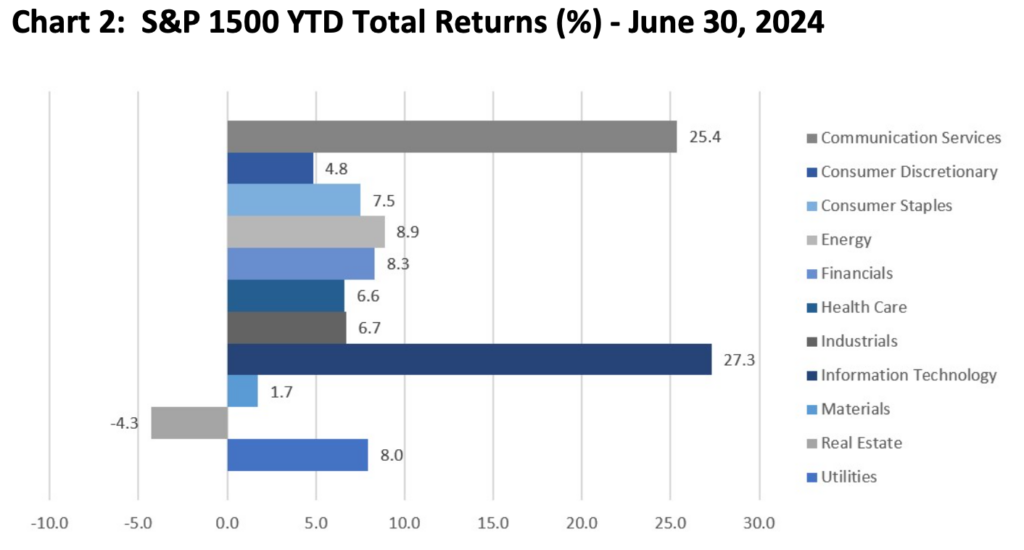

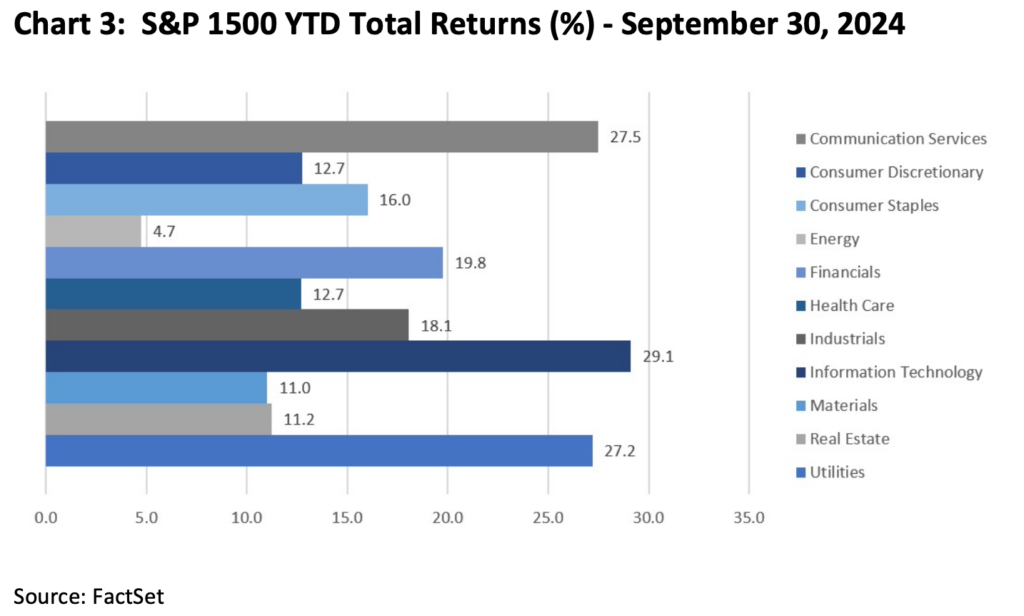

When looking at the S&P 1500 – which is comprised of large-cap, mid-cap and small-cap companies in the US, returns from the underlying sectors within the market broadened

meaningfully during the third quarter. As seen in Charts 2 and 3, markets kicked off the first half of the year with stock market returns predominately generated by Technology and Communication Services companies (namely from semiconductors and Meta). Beginning in early July, returns from the other nine sectors picked up, leaving us with a more evenly distributed contribution of returns. The difference in returns for those sectors materially changed in just a three-month period. As of September 30th, Technology and Communication Services companies remained little changed.

In Liz Ann’s aforementioned article, she refers to the term ‘add low, trim high’. Our team has continued to focus on rebalancing and managing the size of the investments we make, trimming those that have appreciated and reinvesting where appropriate in different areas of the portfolio.