The content contained in this post was written to reflect on the markets in the first quarter 2025 and was published prior to the tariff announcements made on April 2nd, 2025.

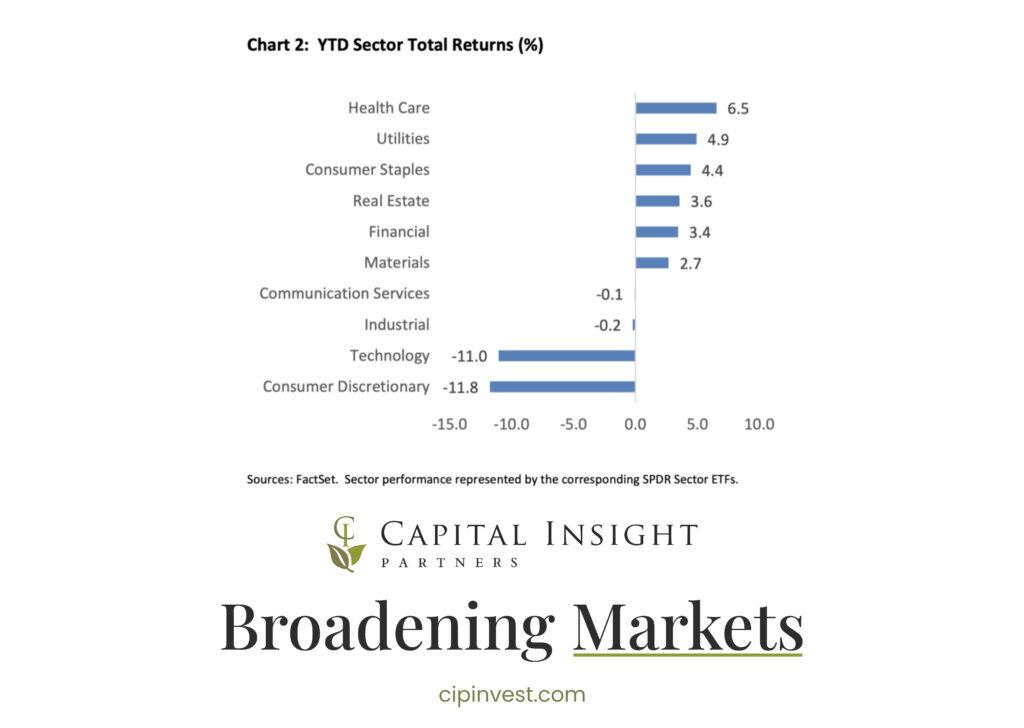

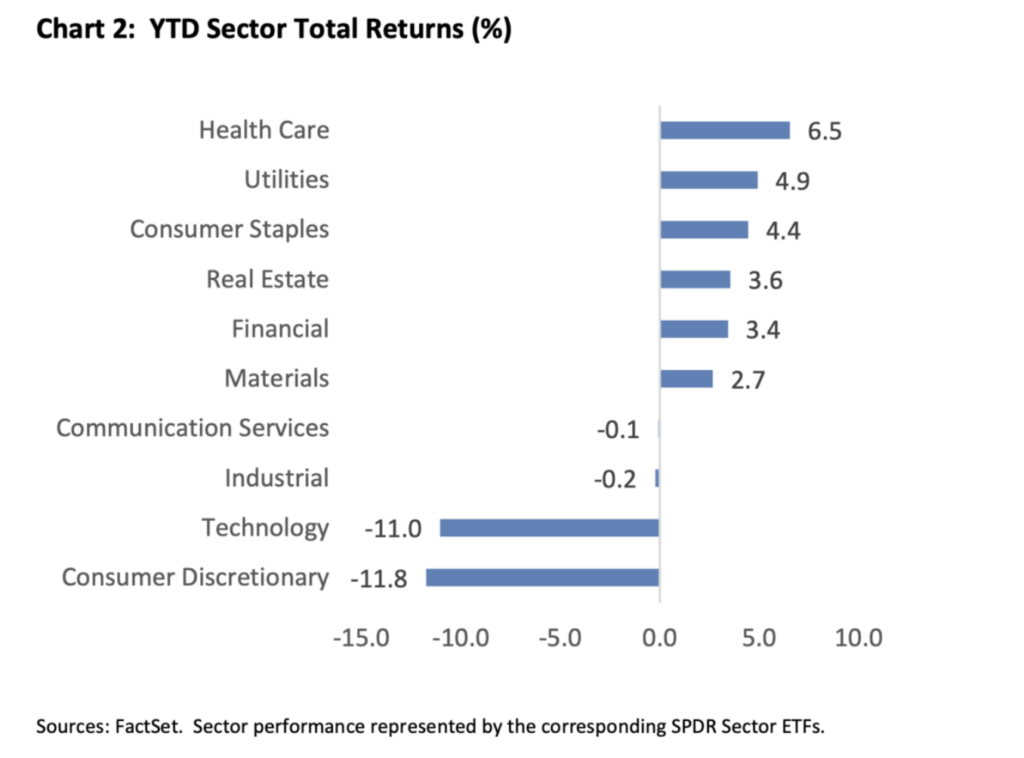

Within the US stock market specifically, two sectors have significantly underperformed the rest. Consumer Discretionary and Technology companies have posted negative returns on the year, while all the remaining sectors are flat or positive (Chart 2 below). As of quarter-end, these two sectors make up approximately 40% of the overall US stock market.

The recently coined Magnificent 7(2) stocks, which are companies primarily within the Consumer Discretionary and Technology sectors, have a large impact on the broader index returns, simply due to the scale at which they hold representation within the index. When these companies do well, the markets do well. When they don’t, the market feels the impact. If you were to rank the companies within the S&P 500’s returns from highest to lowest year-to-date, you would have to go down 266 companies to reach the first Magnificent 7 company, Meta Platforms, with the other six among the lowest performing stocks year to date. A position vastly different than the dominant market leadership they displayed in 2024. Our portfolios have less exposure to these companies than the index, which has been additive to performance this year.

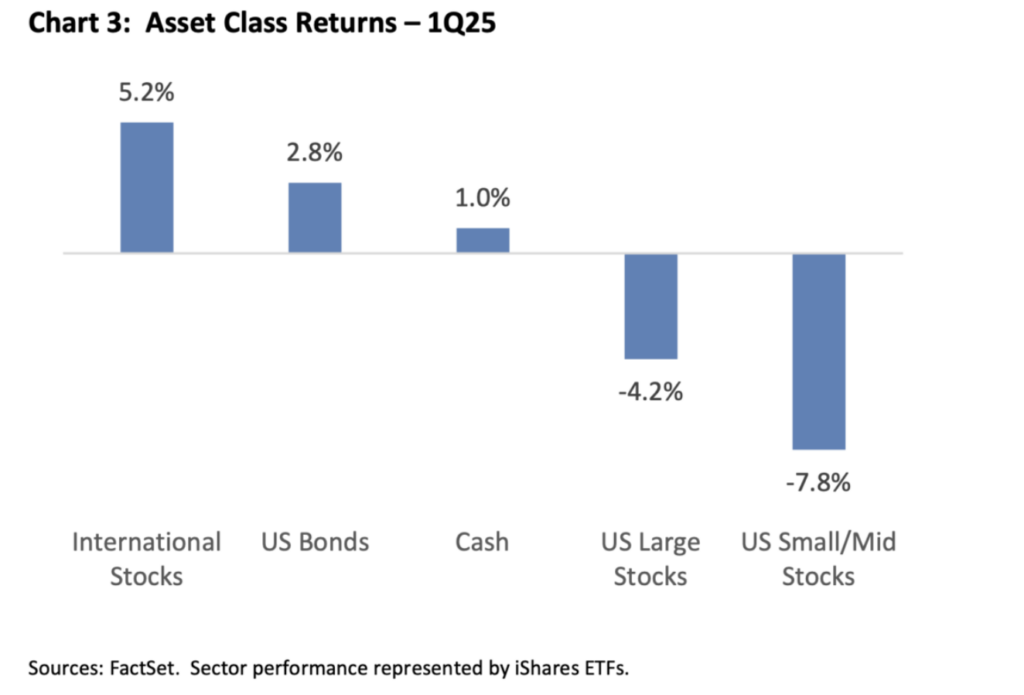

When looking outside of US large cap stocks, small and medium sized companies have also struggled, as the imposition of tariffs weigh on stocks. Outside of the US however, international stocks have rallied with the help of multi decade historically cheap valuations relative to the US, and a declining US dollar. This year has been a good reminder for investors on the importance of maintaining diversified strategies within their portfolios. See Chart 3 below for returns for different asset classes.

A bright spot within client portfolios this year so far has been bonds. A healthy average coupon payment and downward pressure on interest rates have aided in the US Aggregate Bond index posting a year-to-date total return of 2.8%. Where appropriate within client portfolios for those who have investment objectives that include bonds, we have maintained a slightly shorter duration than benchmark (currently ~6 years), while focusing on areas of the market that we feel will give us a little edge while spreads remain tight, such as in mortgage-backed securities and emerging market bonds. Bonds have returned to being a ballast in portfolios offsetting the negative returns from stocks to start the year.