The latest meeting of the Federal Reserve on July 26th produced an additional 0.25% interest rate hike. The future direction of interest rates remains to be determined. Here in the US, inflation has broadly continued to stabilize. While still above the Fed’s target average of 2%, the evaluation of inflation using the Consumer Price Index (CPI) through June reflects an inflation rate of 3% for the previous 12-months as reflected in Chart 1 below.

Chart 1: 12-month percent change in the Consumer Price Index for All Urban Consumers (CPI-U) – June 2023

Source: Bureau of Labor Statistics. July 12, 2023

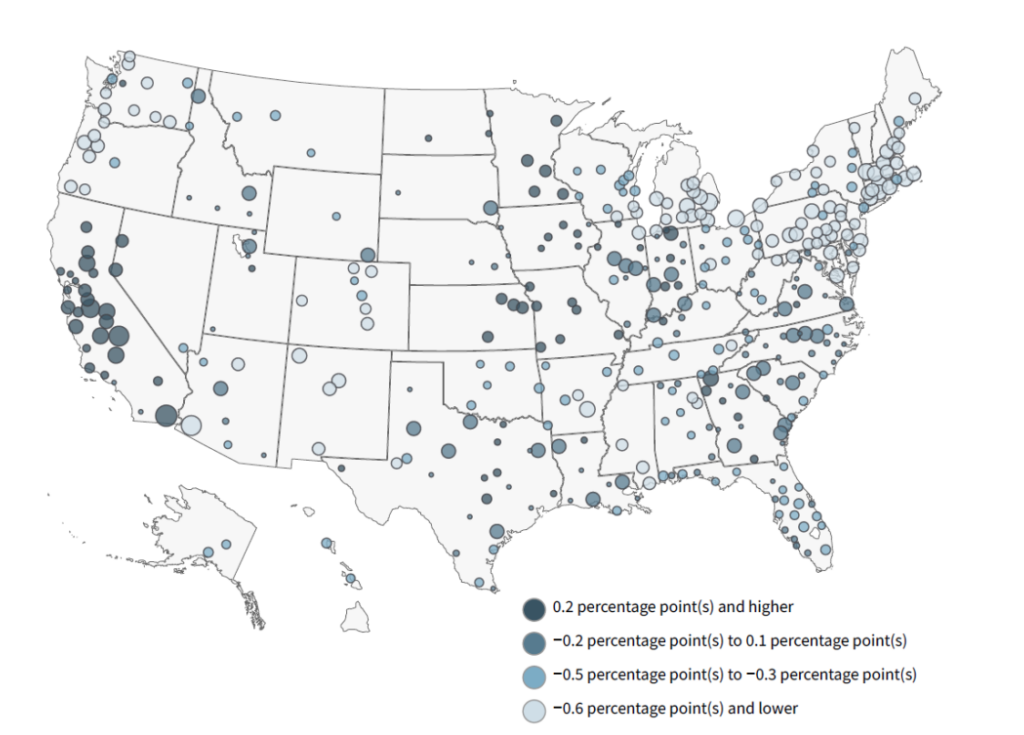

While inflation rates continue to reflect the impact of previous interest rate hikes, the Fed remains on guard. Economic numbers and stock market returns have shown signs of strength anticipating a possible path of interest rate declines. However, what continues to remain sticky is the employment landscape. The low level of unemployment in the US continues to provide support for economic growth. Of primary concern for the Federal Reserve is its impact on the economic engine. Specifically, low levels of unemployment drive demand for higher wages and higher prices. As a result, the Federal Reserve may not be done with interest rate hikes if employment remains strong. As can be seen in Chart 2, the over-the-year change in unemployment rates varies by location. In all, it remains at historically low levels.

Chart 2: Over-the-year change in unemployment rates for metropolitan areas

Source: Bureau of Labor Statistics. June 15, 2023

Investments may fluctuate in value. Investing involves risk including the possible loss of principal. Past performance does not guarantee future results.

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may d