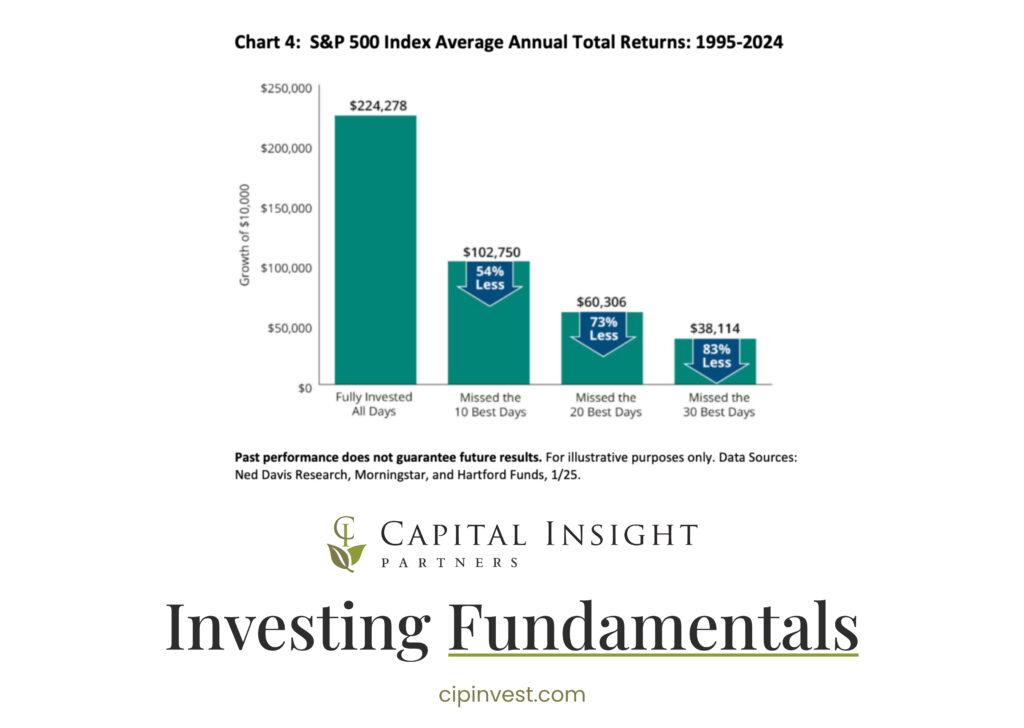

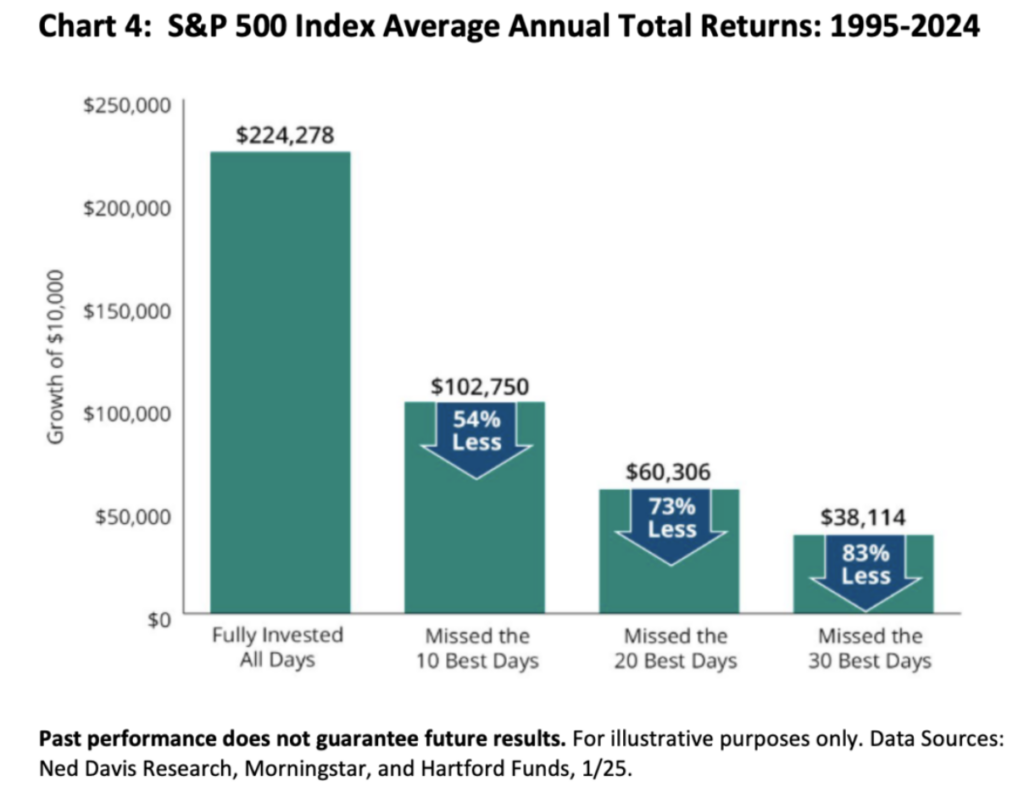

Staying invested and maintaining a diversified portfolio remains critically important over time. Missing the best days in the markets historically has proven to be costly to the overall returns of investment portfolios. As you can see in Chart 4 below, missing even the best 10 days yielded a 54% lower total return than if investors stay fully invested.

Markets experience periods of time where the up and down price movements get more extreme and can last for weeks on end, but sticking with your strategy through the fluctuations generally leads to better outcomes over time. Oftentimes, the best performing days occur right after the worst performing ones, and 50% of the time, the best days occur in bear markets.

Moments like these are timely reminders to stay focused on your long-term goals and not let short-term movements dictate your investment strategy.