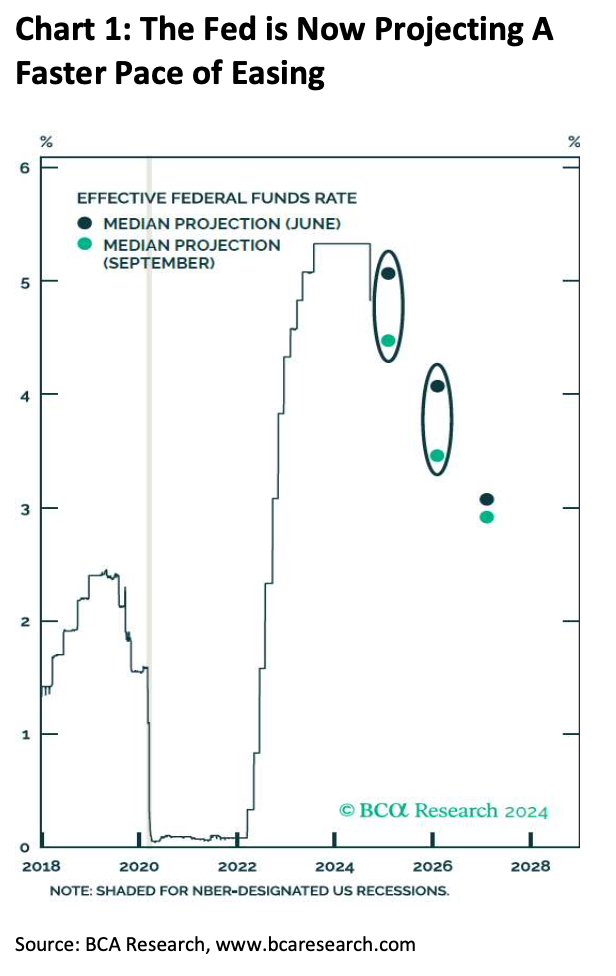

Over the course of the third quarter, the economy broadly experienced signs of easing inflation and softening in the labor market within the US. This lead the Federal Open Market Committee (FOMC) to collectively begin talking with a more dovish tone – a posture more open to rate cuts in the near future. Fast forward to mid-September, the FOMC cut rates by 0.5% to a range of 4.75% to 5%. As seen in Chart 1 to the right, the Fed updated their forecast of rates down at the September meeting versus their projected level at the June meeting, ending 2026 at a forecasted target rate of about 3%. The US economy that grew swiftly in the post-COVID recovery is beginning to slow pace. Given this, it appears that the delicate soft landing is materializing.

A slower growing economy is a natural state of operating, although it can be more sensitive to economic data. The state of the economy is judged on past data with a lag, whereas the markets tend to be forward looking. While the economy may enter a brief recession, the market will likely look past that and continue moving forward. There has been growth overall in company profits and earnings this year, and analyst estimates reflect continued momentum into 2025. That being said, with the election now just a few weeks away, we do expect continued volatility in the markets through year-end.