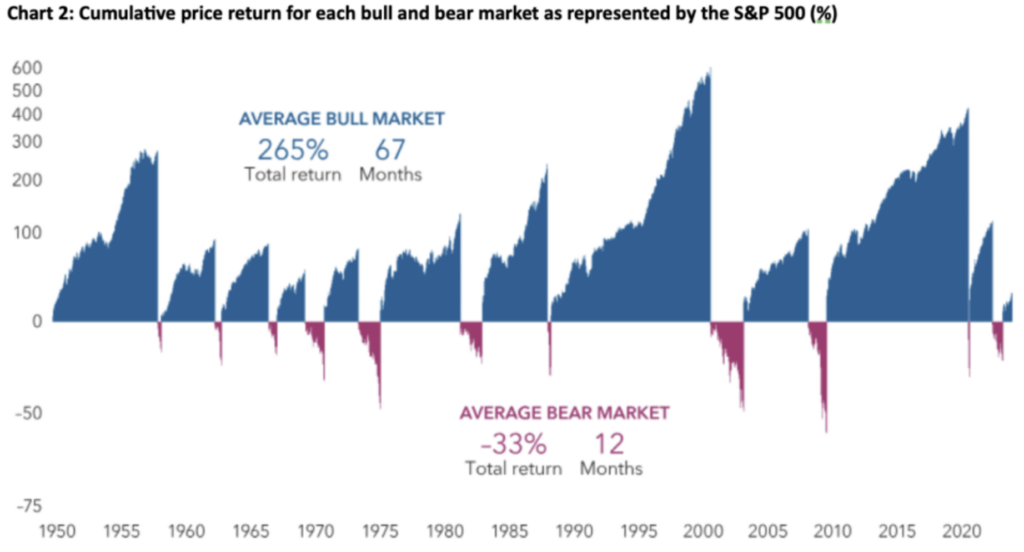

As the memory of 2022’s lackluster stock and bond market performance begins to fade, what remains is the emotional response during the period of a rapid rise in inflation and corresponding interest rates. Q4 2023 and Q1 2024 have produced strong stock market returns. While it is natural to begin to assess the speed of the recent uptick in performance, arguably driven by a select group of technology focused companies, an important perspective to reflect on is the average length of a bull market. As shown in Chart 2 below, multi-year periods of stock market growth tend to follow bear markets on average. This pattern supports broadening the focus of your investing time horizon.

Sources: Capital Group, RIMES, Standard & Poor’s. Includes daily returns for the S&P 500 index from 6/13/49-6/30/23. The bull market that began on 10/12/22 is considered current and is not included in the ‘average bull market’ calculations. Bear markets are peak-to-trough price declines of 20% or more in the S&P 500. Bull markets are all other periods. Returns are in USD and are shown on a logarithmic scale. Past results are not predictive of results in future periods.