The content contained in this post was written to reflect on the markets in the first quarter 2025 and was published prior to the tariff announcements made on April 2nd, 2025.

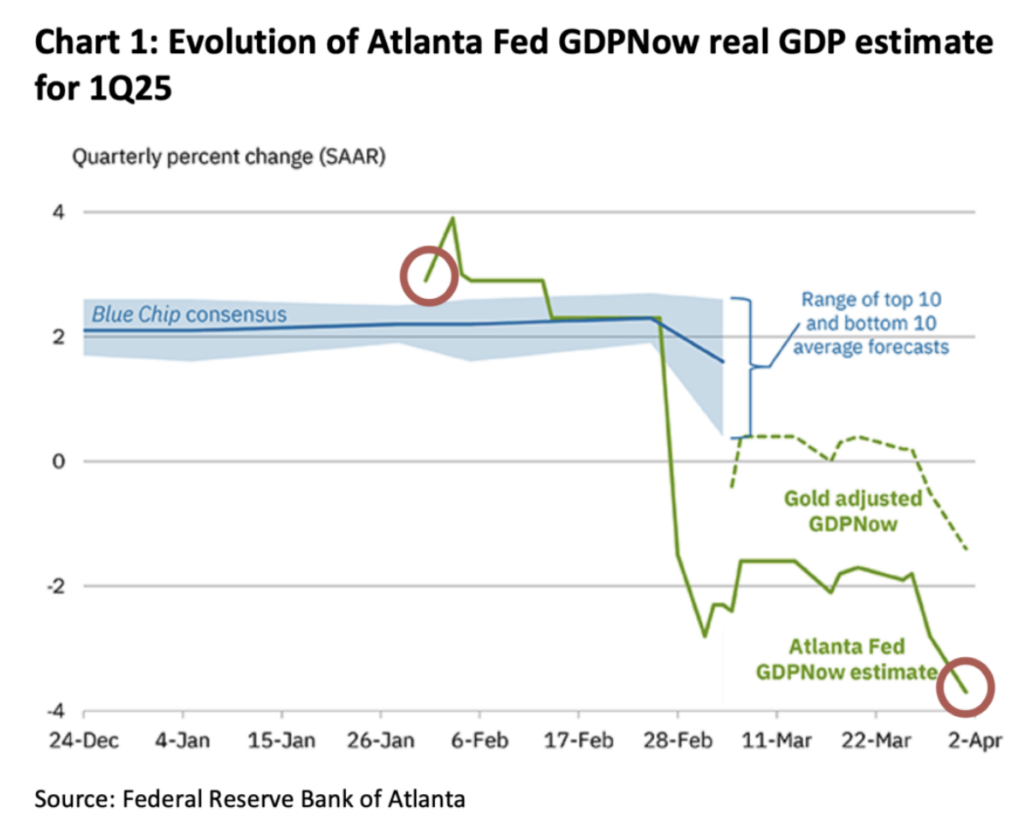

The US Economy is showing signs of rapidly cooling over the past quarter. The Atlanta Federal Reserve’s GDPNow measure, which models economic data such as personal consumption, inflation, net exports and business investment in real time as data is released, is estimating that US real GDP will contract -3.7% in the first quarter, down from -2.8% just a week ago. At the start the year, the model was estimating the economy would grow 2% and has evolved quickly as we moved through the quarter.

As illustrated by the green line in Chart 1 below. PCE Inflation has peaked its head again rising to 2.5%, moving further from the Federal Reserve’s long-term target of 2% while unemployment has held steady at 4.1%. Earnings estimates for companies have come down from a growth rate of 14.5% at the beginning of the year to 11.7% (which is still above a long-term average), further reinforcing a slower growth environment.

Recent surveys have measured consumer sentiment dropping, nearing their COVID low levels. When consumer confidence goes down, consumption spending tends to follow trend. When your friends, family or neighbors are being impacted economically or worse starting to losing their jobs, that often spills over in to how we manage our own finances… watching purchases more closely and incrementally increasing our own savings to plan for near-term ‘what if’s’. Roughly two thirds of GDP produced in the US is spending, with the top 10% of consumers accounting for about 50% of consumption. If demand can remain steady, the economy can continue to grow albeit at a slower pace. If it starts to deteriorate, there will likely be further pain felt in the economy and markets. We expect the Federal Reserve to remain cautious in their language and projections, while having a close eye on the unemployment numbers. Current projections anticipate two rate cuts in 2025.