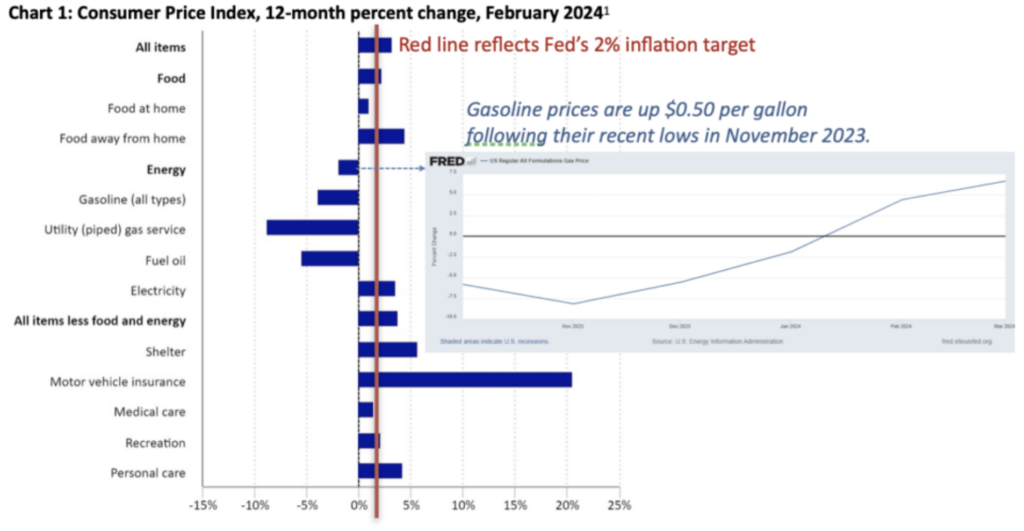

The US economy has continued to remain robust following the rise of interest rates which culminated last July. While this has not been the case for other developed countries across the world, the strength of the domestic economy continues to provide mixed signals as we look forward. The Federal Reserve recently reaffirmed their plans to cut interest rates in 2024. Currently, the Fed anticipates three rate cuts in 2024 (0.25% per cut expected). However, as illustrated below, inflationary pressures in certain areas of the economy continue to provide obstacles to the Fed’s goal of 2% average inflation.

As of the most recent reading, inflation as measured by the Consumer Price Index, nudged slightly higher to an annualized rate of 3.2% versus the 3.1% measured in January. As economic strength continues to remain above expectations, the possibility that the Fed maintains the current level of interest rates at a range of 5.25%-5.50% increases.