Overview:

• The FOMC cut rates by 50 bps, and signaled a more dovish tone in their forecast of the Fed Funds Target Rate.

• A slower growing economy is a natural state of operating, although it can be more sensitive to economic data.

• Returns from stocks are broadening amongst the sectors underlying the market.

• Following the first Fed cut, opportunities exist in both stocks and bonds, regardless if a recession materializes in the near term.

Economy

Over the course of the third quarter, the economy broadly experienced signs of easing inflation and softening in the labor market within the US. This lead the Federal Open Market Committee (FOMC) to collectively begin talking with a more dovish tone – a posture more open to rate cuts in the near future. Fast forward to mid-September, the FOMC cut rates by 0.5% to a range of 4.75% to 5%. As seen in Chart 1 to the right, the Fed updated their forecast of rates down at the September meeting versus their projected level at the June meeting, ending 2026 at a forecasted target rate of about 3%. The US economy that grew swiftly in the post-COVID recovery is beginning to slow pace. Given this, it appears that the delicate soft landing is materializing.

A slower growing economy is a natural state of operating, although it can be more sensitive to economic data. The state of the economy is judged on past data with a lag, whereas the markets tend to be forward looking. While the economy may enter a brief recession, the market will likely look past that and continue moving forward. There has been growth overall in company profits and earnings this year, and analyst estimates reflect continued momentum into 2025. That being said, with the election now just a few weeks away, we do expect continued volatility in the markets through year-end.

Broadening Markets

Liz Ann Sonders, Chief Investment Strategist at Charles Schwab, periodically updates an article named ‘Panic Is Not a Strategy—Nor Is Greed’ originally written in 2008 (link at end). The basis of the article is to help remind investors to refocus on having a diversified investment strategy (even within an asset class like stocks) based on their risk tolerance and financial plan – in times of uncertainty AND optimism. Throughout time, there have been numerous studies of the power of this concept, and the third quarter of 2024 was a good reminder of this.

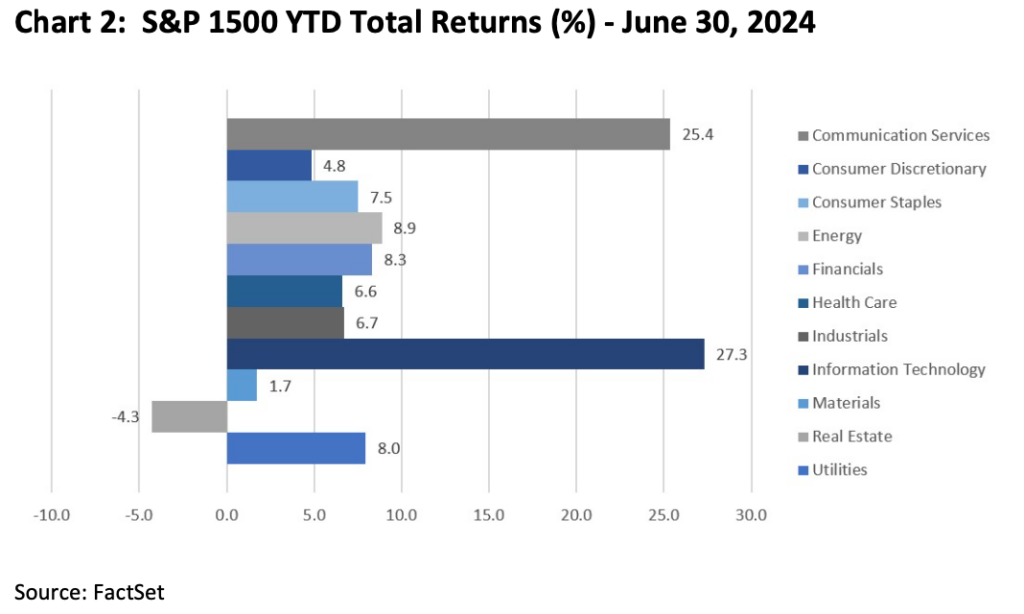

When looking at the S&P 1500 – which is comprised of large-cap, mid-cap and small-cap companies in the US, returns from the underlying sectors within the market broadened meaningfully during the third quarter. As seen in Charts 2 and 3, markets kicked off the first half of the year with stock market returns predominately generated by Technology and Communication Services companies (namely from semiconductors and Meta). Beginning in early July, returns from the other nine sectors picked up, leaving us with a more evenly distributed contribution of returns. The difference in returns for those sectors materially changed in just a three-month period. As of September 30th, Technology and Communication Services companies remained little changed.

In Liz Ann’s aforementioned article, she refers to the term ‘add low, trim high’. Our team has continued to focus on rebalancing and managing the size of the investments we make, trimming those that have appreciated and reinvesting where appropriate in different areas of the portfolio.

Interest Rates’ Impact on Stocks & Bonds:

The Federal Funds Rate has been held steadily north of 5% for over a year. At the September meeting, the FOMC not only cut rates, but more importantly, signaled a faster pace of easing policy than was projected at June’s meeting. Rate cuts can be a sign of easing the tightening cycle (taking your foot off the break to coast), OR that there is a looming recession. Rates can be cut without a recession present, in fact they did so in 1971-72, 1984-86 and 1995-98. Chart 4 on the left illustrates from 1966 to present how stocks and bonds have performed on average in each scenario. We believe the left image of a Fed cut with no recession is more likely to be realized.

Given the level of the initial cut and the FOMC’s forecast of future rates, our current takeaway is that these actions are more about signaling to the market that the risks are subsiding on the inflation front and that they are trying to get ahead of the employment landscape before it turns for the worse. While additional risks exist, we believe this is the case more than indicating looming deeper stress in the economy. Of course, this is always subject to change as new data arises.

Businesses make their strategic planning decisions on when to invest in operations for future growth, based on the return on investment being greater than the cost of capital. While lower interest rates take time to work through the system, it spurs economic activity. This can be a catalyst for companies, leading to a positive impact on stock prices over time.

From a bond perspective, the yield curve is no longer inverted, meaning that for the first time in 26 months (the current inversion is the longest on record), the yield on a 10-year Treasury bond is greater than the yield on a 2-year Treasury bond. An inverted yield curve signals investors’ pessimism about the economy, whereas a normal yield curve that is upward slopping signals future optimism. Recall, as rates go down, bond prices go up due to the inverse relationship that exists. Bonds continue to hold an important role in portfolios where warranted. When appropriate given a client’s risk tolerance, we have been adjusting the amount of bonds held in accounts and the composition of the holdings underlying.

In Closing

While there is a lot to be excited about going forward in the global markets, we aren’t completely out of the woods yet. Sticking to a well-diversified strategy and having clarity on your investment time horizon is key. Just as when children first learn to ride their bike without training wheels, the economy and markets will likely experience a wobbly path ahead until it finds its confidence to proceed with ease. On behalf of our entire team and colleagues, we wish you joy in the holiday season ahead and offer support on the continued pursuit of your Freedom to live an inspired lifeTM.

For additional reading pleasure, below are links to articles our team has found timely and relevant: Liz Ann Sonders, Panic Is Not a Strategy—Nor Is Greed, Updated September 16, 2024

Craig McCrory, CFA: Election 2024: Maintain Focus on What You Can Control, July 23, 2024

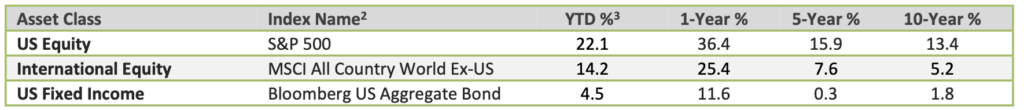

Index performance through September 30, 2024:

Investments may fluctuate in value. Investing involves risk including the possible loss of principal. Past performance does not guarantee future results.

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

The term federal funds rate refers to the target interest rate set by the Federal Open market committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight. The FOMC which is the policymaking body of the Federal Reserve System, meets eight times a year to set the target federal funds rate, which is part of its monetary policy.

2Index returns are for illustrative purposes only and do not represent actual performance of any investment. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. The Standard & Poor’s (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization U.S. stocks. The MSCI All Country (AC) World ex U.S. Index tracks global stock market performance that includes developed and emerging markets but excludes the U.S. The Bloomberg U.S. Aggregate Bond Index is a broad-based fixed-income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance

3Index returns provided through Envestnet Tamarac, underlying data provider: Thomson Reuters.