Optimism (and possibly exhilaration) shines again as the vaccine rollout against COVID-19 continues across the US and the rest of the world. As of this writing, the CDC reports that nearly 30% of the total US population (97.5 million people) has received at least one dose of the vaccine and 16% (54.6 million people) are fully vaccinated. Forward-looking financial markets have thus far been on the winning side of the recovery trade, and we expect this economic recovery to continue.

As reflected in the year-to-date results below, the first quarter of 2021 has continued the stock market rally from 2020. Since Election Day, US stock market prices, as represented by the S&P 500, had only 4 days (out of 101) where the market moved greater than 2% on a single day. In fact, the last time we experienced a market decline of 5% or more in a single day was back on June 10, 2020, over 200 days ago! Since World War II, the average number of days without this size of a decline is 1761.

Year-to-date index performance through March 31, 2021:

| Asset Class | Index Name2 | YTD %3 |

|---|---|---|

| US Equity – Large Cap | S&P 500 | 6.2 |

| US Equity – Small/Mid Cap | Russell 2500 | 10.9 |

| International Equity – Large Cap | MSCI All Country World Ex-US | 3.5 |

| US Fixed Income | Bloomberg Barclays US Aggregate Bond | (3.4) |

| Alternatives – Real Estate | MSCI US REIT | 8.8 |

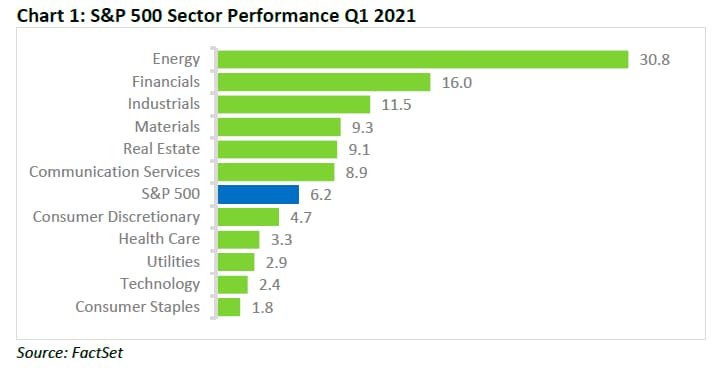

Return to normalcy continues to remain the consensus goal for us all. With the appearance of light on the economic horizon, an undercurrent of change has been occurring in financial markets. While technology reigned supreme in 2020, investors are beginning to find value in underappreciated areas of the market that have generally been out of favor. Sectors that are sensitive to the economy (cyclical) such as energy, financials, and industrials have outperformed the broader stock market. This is driven by the expanding economic recovery along with expectations of interest rate increases and governmental policy change.

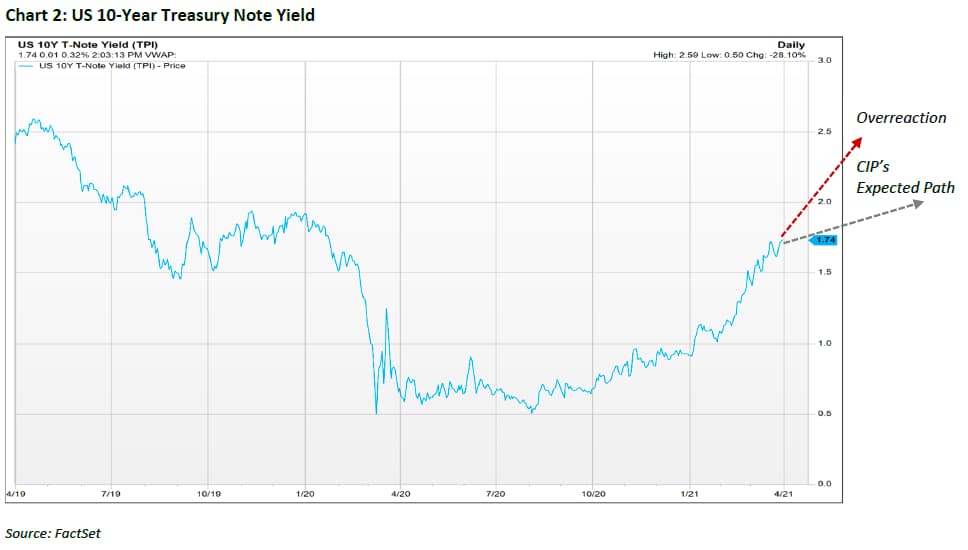

Contrary to the Federal Reserve reaffirming their accommodative interest rate policy as the economic recovery continues, interest rates extended their upward momentum during the quarter. The yield on the US 10-Year Treasury Note increased to 1.74% from 0.92%, an 89% increase! Bond investors expressed their concern that the Federal Reserve is discounting the speed of the economic recovery. As shown in Chart 2 below, rather than continue the brisk pace of the first quarter, we expect interest rates to stabilize and then to gradually increase over time with periods of brief volatility as pressures on supply and demand within our economy subside.

Outside of the Fed’s actions, inflation fears are also on the mind of investors. As mentioned in our January Economic & Market Outlook, price increases are visible throughout many parts of our daily lives. We maintain our view that inflationary pressure will remain with us in the near-term and transition to normalized levels as the economy continues its return to pre-COVID levels.

As referenced in the comments above, the quarter generated several action steps across many of our client accounts. As a general comment, we have continued to evaluate stock and bond weightings across accounts and rebalance where appropriate. While we continue to favor stocks over time, the recent strong performance and high valuations created the need to realize gains in select stock positions, close out certain positions in full, as well as adjust overall asset class weightings. We are closely monitoring demand for consumer services as deferred expenses to a later period may disappear the longer restrictions persist. We are also following the economy for possible signs of overheating. On the bond side, continued reduction to the average maturity of the bond portfolio was completed since it is clear to us the 40-year bull market in bonds has ended.

Last, we have three housekeeping items to share. On behalf of the firm, I wish you a safe and healthy spring:

- ADV Disclosure Document: If you are interested in receiving a copy of the latest updated document, please visit our website or submit a request to Susan Anastasiadis at susan@cipinvest.com or (480) 295-7070.

- Reinstatement of Annual Required Minimum Distributions (RMD): While it is early in the year, we are beginning to have conversations around required mandatory distributions from retirement accounts. Last year due to the CARES Act, the distribution requirement was waived for 2020. This year, the requirement has been reinstituted for clients aged 72 and above along with some Inherited IRA account holders. Many clients may be surprised by the size of this year’s required distribution due to strong market performance and when compared to the previous 2019 RMD amount which was based on the depressed account values in December 2018. As distribution amounts are determined using a calculation of the year-end value along with life expectancy, you should expect an increase in the annual required distribution amount. While this is bad news from a tax perspective, account performance for most clients has more than offset any increase in tax obligation.

- Corporate Actions and Proxy Voting for European Stocks (Schwab Accounts): For many of our clients holding accounts at Schwab, you may have recently started receiving notices via email and mail requesting your vote on corporate actions on European stocks held in your account(s). Unless you have reserved the right, Capital Insight Partners (CIP), through a relationship with Broadridge, traditionally votes all corporate actions and proxy votes on your behalf. Recently, Schwab signed on to follow the new Shareholder Rights Directive for European Stocks (SDRII). We are currently working with Schwab and Broadridge to ensure that CIP continues to vote these corporate actions. Please note that you may continue to receive notices as we resolve this issue.

Investments may fluctuate in value. Investing involves risk including the possible loss of principal. Past performance does not guarantee future results.

(1) CFRA, The Outlook. March 22, 2021.

(2) Index returns are for illustrative purposes only and do not represent actual performance of any investment. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index.

(3) Index returns provided through Envestnet Tamarac, underlying data providers: Thomson Reuters except for Russell 2500 which is provided by Russell.