Overview

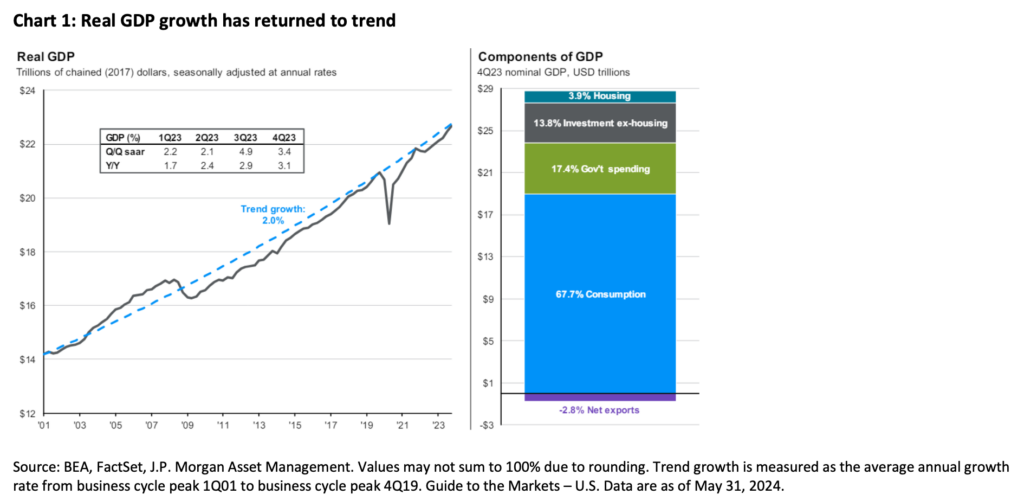

- GDP growth has returned to its long-term trend line; however, consumers are affected by interest rates differently

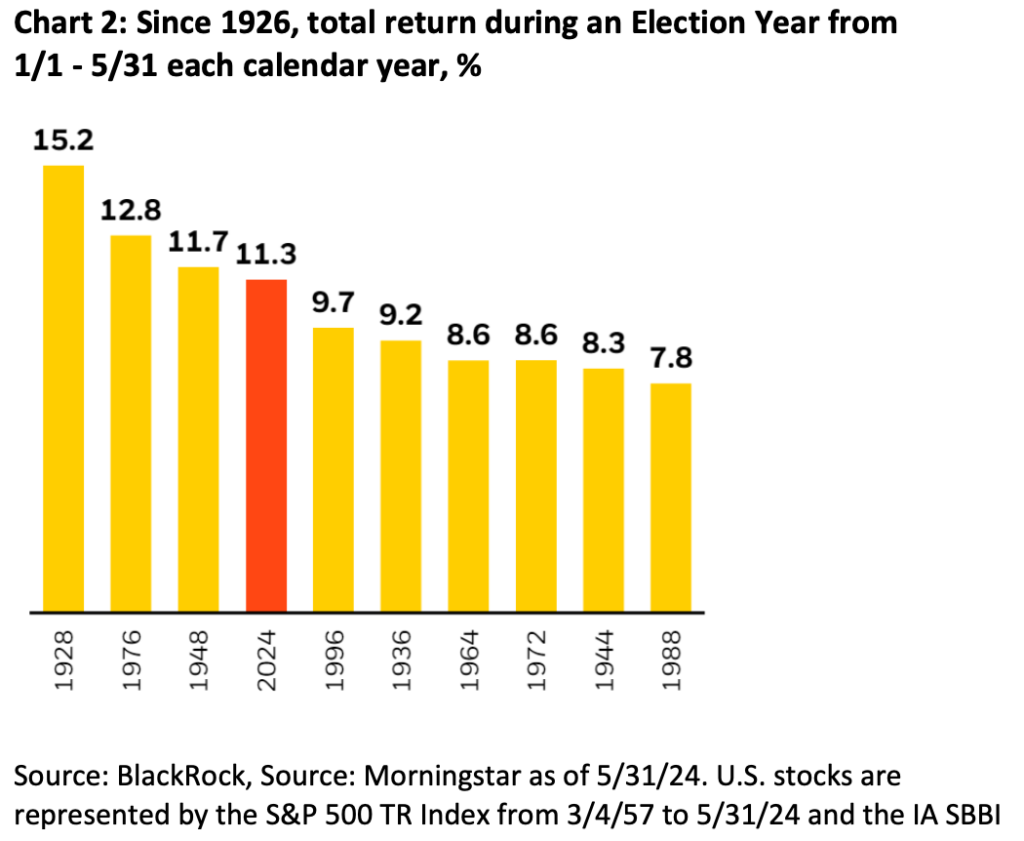

- The US has experienced the 4th best start to the year during an election year when looking at returns through May 31, 2024

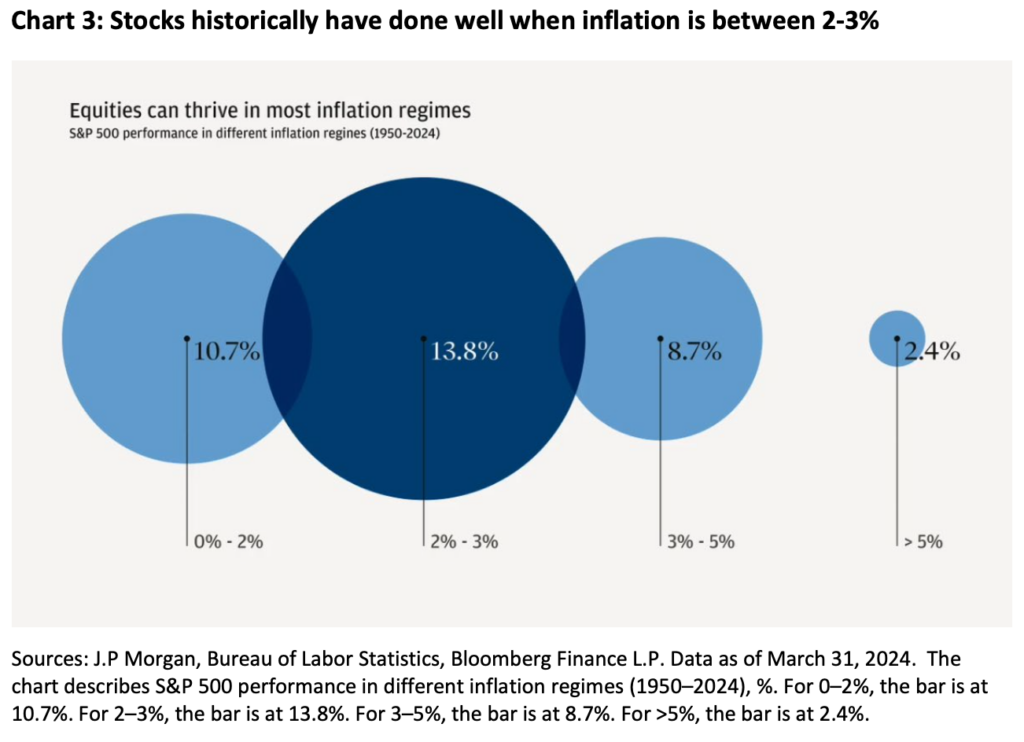

- Stocks have historically done well during periods of 2-3% inflation (average annualized)

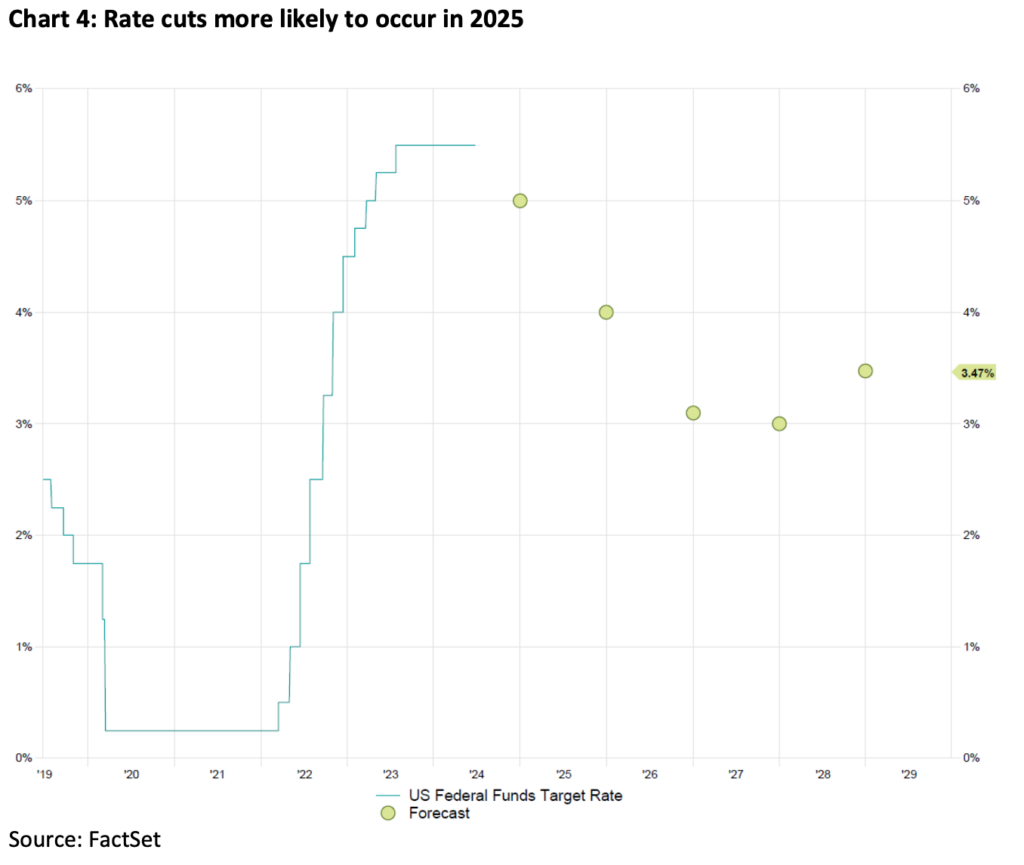

- Opportunities for total return in bonds exist outside of US Treasuries

- Savings vehicles, such as CD’s and money markets, adjust rates down ahead of anticipated interest rate cuts

As we reach the middle of 2024, we are taking a moment to pause and reflect back on some of the topics discussed at our January Economic & Market Outlook event and provide our current thinking and perspective as we move in to the second half of the year.

Economy

The US economy has continued to show strength as increases in the production of goods and services, also known as GDP growth, has returned to its long-term trend line that it had deviated sharply from during the COVID-19 pandemic. With roughly two thirds of GDP driven by consumption, consumer spending is starting to show signs of slowing which may translate in to a more moderate rate of GDP growth in the quarters ahead. While higher interest rates have benefited some consumers through income earned (and thus spent on goods and services), pockets of consumers are feeling the pressure of persistent higher inflation and higher rates (interest owed on debt).

Stocks

More citizens globally will cast democratic election ballots in 2024 than ever before1. Outside of the US, relevant elections occurring this year will also take place in India, Japan, Mexico, South Africa and the UK.

With Election Day now just 4 months away, it often feels like the US has been living through the current campaign cycle for a long time. The US does actually have a longer election cycle than most other democracies. For comparison, Mexico’s general election campaign lasts three months, and in the UK, the campaign lasts just 25 days!2

From a stock market perspective as seen in Chart 2, the US has experienced the 4th best start to the year during an election year when looking at returns through May 31, 2024.

One likely explanation for this is that market participants generally know what could be expected from a fiscal policy standpoint during a presidency of either primary candidates: former President Trump or President Biden. This has likely led the market to shrug off the uncertainty that would traditionally persist during the first half of the election year. While we are anticipating an emotional election season through November, it is important to remain consistent with your long-term investment strategy.

Outside of the election and sticking with stocks, the fight against inflation has stalled in the last several months, lingering at a level that is still above the Fed’s long-term target of a 2% average inflation rate.

Even in a 2-3% inflation rate environment, stocks historically have produced attractive returns mainly due to their ability to manage the increased input costs, and/or easily pass them through to consumers. In client accounts where individual stocks are held, we are maintaining a balance of companies that are able to pass through inflation cost increases, paired with having exposure to growth-oriented companies.

Bonds

At the beginning of the year, the bond market was anticipating that the Federal Reserve would cut interest rates 4-6 times during 2024. Our general consensus as a team at the time was that we would see rate cuts, albeit fewer than the market was anticipating given the overall strength of the economy and US consumers. Fast forward to mid-year (having experienced no cuts at this point), the Fed’s current forecast is for just two interest rate cuts at 0.25% each, ending the year at a 5% Federal

Funds Rate. While the visibility of future rate cuts remains unclear, one to two 0.25% rate decreases appears to better align with anticipated market conditions over the next 6-12 months.

Given the outlook for government yields, we believe it is appropriate for investors to look beyond treasuries for investment opportunities in fixed income.

Recently, where appropriate in client accounts given their investment objectives, we added exposure in the bond sleeve to Mortgage-Backed Securities. In addition, we exchanged our Emerging Market Bond position from local currency to US dollar denominated given the continued strength of the US dollar versus other currencies around the world. We are still neutral in bond maturities relative to the market, but believe there will be a time in the near future where it will be beneficial to extend and lengthen the average maturity of our bonds beyond the market average.

Cash

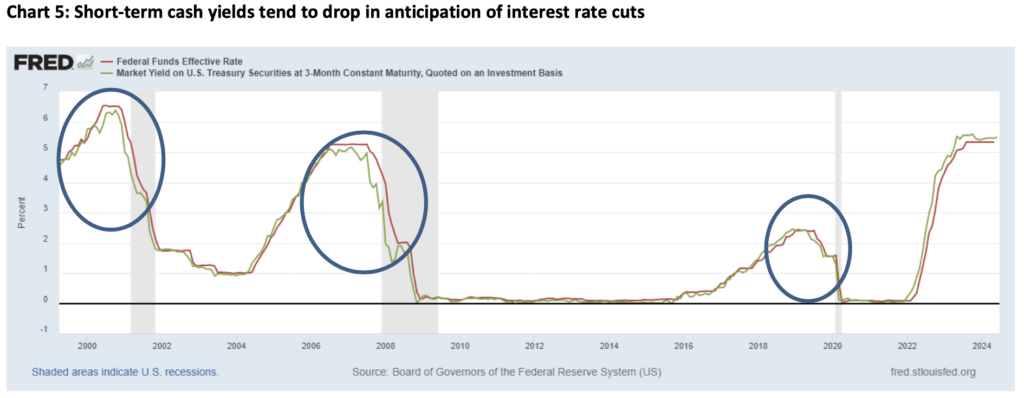

As highlighted in our Outlook event in January, interest rates and savings yields tend to take the stairs up and the elevator down through a full rate hiking and rate cutting cycle. Savings vehicles such as Certificates of Deposit (CDs) and Money Market Funds (MMFs) begin to reduce the rates offered in anticipation of expected rate cuts by the Fed.

As seen in Chart 5 below, during the three most recent rate cutting cycles, the blue circles highlight short-term market yields (income earned on investments) dropping sooner (green line) and swifter than the Federal Funds Effective Rates (red line), which is the policy rate controlled by the Federal Reserve. While we are expecting interest rate cuts in the future, the likelihood of them returning to near zero is slim. Though it is expected that cash and cash equivalent investments will continue to offer higher interest rates than seen in the last decade, we estimate the future prospective total returns from both stocks and bonds will outweigh the income earned in the near-term. We encourage a review of the allocation of cash in your overall investment strategy with your financial advisor and to create or reaffirm your plan for cash needs that is in alignment with your future goals.

In Closing

While there is no shortage of data points and headline activity to assess on a daily basis, it is important to ‘zoom out’ and look at the investing landscape through a longer-term lens consistent with your investment timeline. We believe there are investment opportunities for growth across asset classes and, as a result, we continue to engage in rebalancing positions to target weights, across stocks, bonds and cash, consistent with your investment objectives.

As we all brave the heat across the country, we hope you find yourself enjoying many wonderful (and cool) moments this summer. Please reach out to your investment professional if you have any comments or questions on the updates above. On behalf of our entire team and colleagues, we wish you the best in the pursuit of your Freedom to live an inspired lifeTM.

Investments may fluctuate in value. Investing involves risk including the possible loss of principal. Past performance does not guarantee future results.

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

1 The Economist as of March 31, 2024

2 https://www.pbs.org/newshour/politics/why-u-s-election-campaigns-feel-so-long

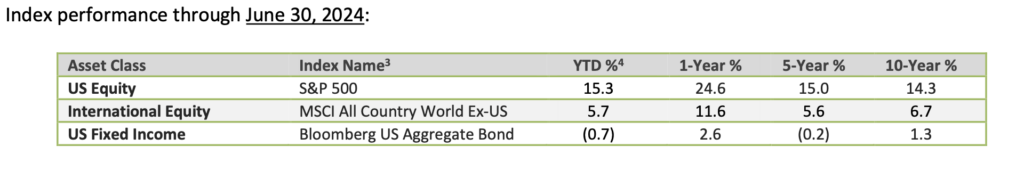

3 Index returns are for illustrative purposes only and do not represent actual performance of any investment. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. The Standard & Poor’s (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization U.S. stocks. The MSCI All Country (AC) World ex U.S. Index tracks global stock market performance that includes developed and emerging markets but excludes the U.S. The Bloomberg U.S. Aggregate Bond Index is a broad-based fixed-income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance

4 Index returns provided through Envestnet Tamarac, underlying data provider: Thomson Reuters.