Overview

- A reflection on current events reminds us to maintain focus on the stated investment objectives.

- Following the Federal Reserve’s recent meeting which resulted in leaving the federal funds interest rate unchanged at a range of 5.25%-5.50%, our view remains that the US economy is likely to slip into a mild recession.

- The result will likely be a short-term drag on stock performance and an opportunity for bonds.

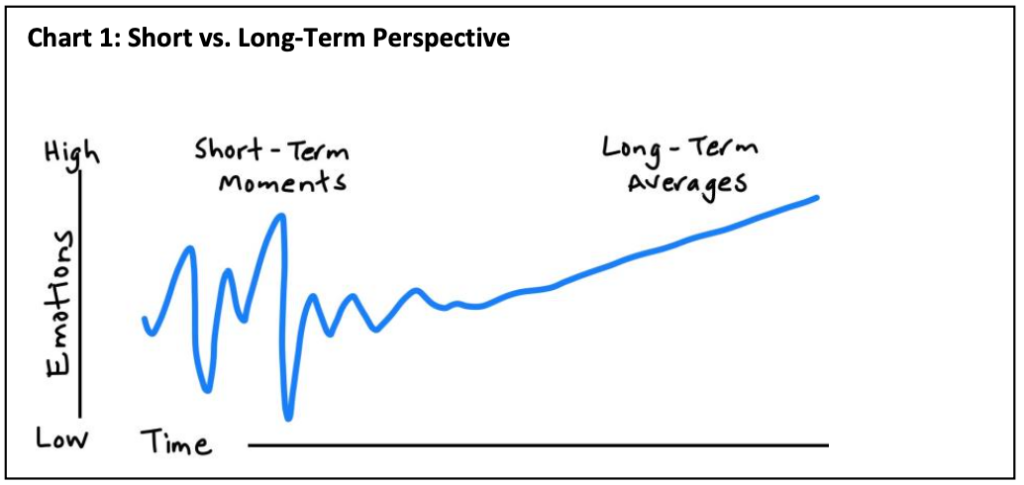

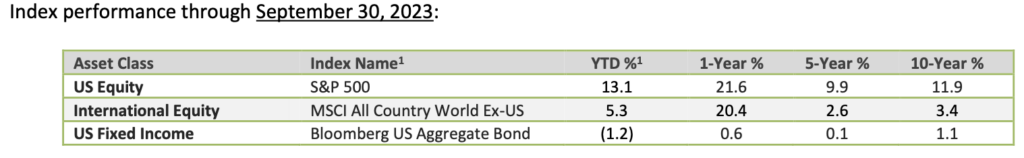

September continued to follow the historical trend of being a difficult month for stocks. The US S&P 500 index pulled back -4.8% and the broad global MSCI World stock market index fell -4.3%. Performance struggles were broad across most sectors outside of energy and utilities with technology leading the recent reversal. With a back drop of stock markets being positive for the year, a subject at a recent investment team meeting was how much activity this year has included and how much noise is ahead. Far from an exhaustive list, 2023 has thus far included the avoidance of a US debt default resulting in a credit downgrade, a regional banking crisis, continued conflict in Ukraine, Federal Reserve interest rate hikes, AI becoming part of nearly every conversation (and possibly participating in it!), and who could forget Chinese spy balloons. Current events include a strike by the United Auto Workers union (UAW), possible US government shutdown, Chinese real estate concerns, and ever-looming events leading into next November. All said, there is no shortage of emotional exit ramps to potentially derail anyone’s investment goals. With clouds in the sky, it is important to have clarity on your investment objectives during times of uncertainty. As history would suggest, these too shall pass. Our opinion is the capital opportunities within and outside our country remain favorable for those willing to focus beyond the very near-term.

Calling all Pilots: Perspective on US completing a hard, soft, or no economic landing

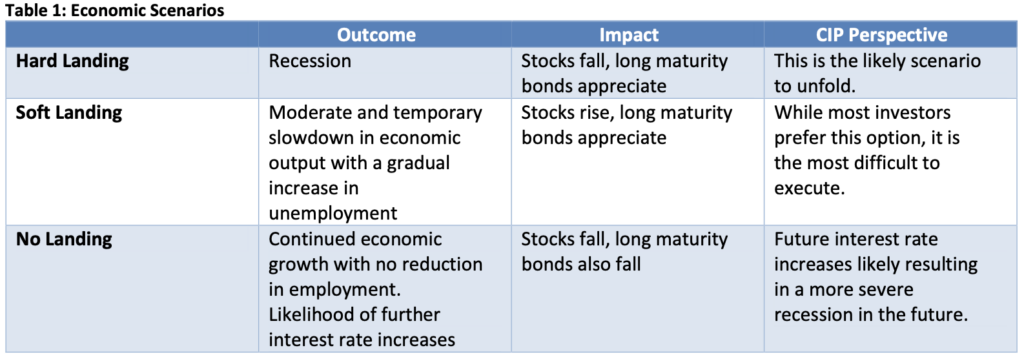

As mentioned previously, the Federal Reserve left interest rates unchanged at their recent September meeting. Their dual mandate of maximum employment and price stability (maintaining average inflation at 2%) has been challenged throughout the pandemic. As broad inflationary measures subside from recent peaks, investors are speculating on the timing of when the Federal Reserve will begin to reduce interest rates. This exercise has led to discussions surrounding the likelihood of whether or not the country will enter or avoid a recession. Three possible outcomes have been raised and are coined as either a hard, soft, or no landing.

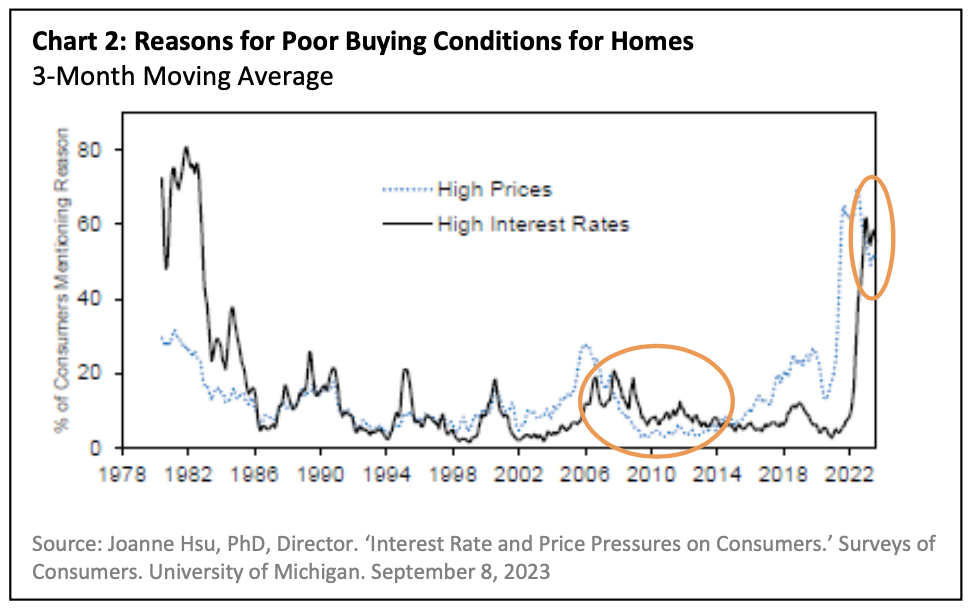

Avoiding the term transitory, our team’s opinion is that the US economy has not yet seen the full impact of the rapid rise in interest rates in the last 18 months. Following the pilot’s priority checklist of ‘aviate, navigate, and communicate’, we remain in the navigate phase of the process. Taking the recent action of ‘no action’ as it relates to interest rate changes indicates that the Federal Reserve prefers further data (time) in order to determine next steps. In terms of data, the recent University of Michigan Surveys of Consumers reflects that consumers looking to purchase a house are stating that both high prices and high interest rates are having an adverse impact on their ability to purchase a home. From Chart 2 below, it is interesting to note that interest rates came in slightly above prices as the most material reason. The last time this was the case was following the recovery from the Global Financial Crisis through the early part of the last decade.

As stated in Table 1 above, our team views the ‘hard landing’ as the most likely outcome. While it is not exciting to discuss a recession, it seems that an economic slowdown including stabilization in employment would provide benefits to the long-term productivity of the economy and ultimately financial markets. In addition, we view the ‘no landing’ scenario as the highest risk to performance in the financial markets. While stocks may initially respond favorably to this scenario, the concern is that the economy may overheat again causing more aggressive interest rate increases and thus generating a more severe recession than is our base case. As a result, portfolio decisions over the last 2 years and those currently being assessed by the team are focused on these two outcomes. While the ‘soft landing’ scenario would be the preferred landing of choice for most investors, the ability to navigate the complexities of slowing the economy and stabilizing employment without stalling out the economy is unlikely.

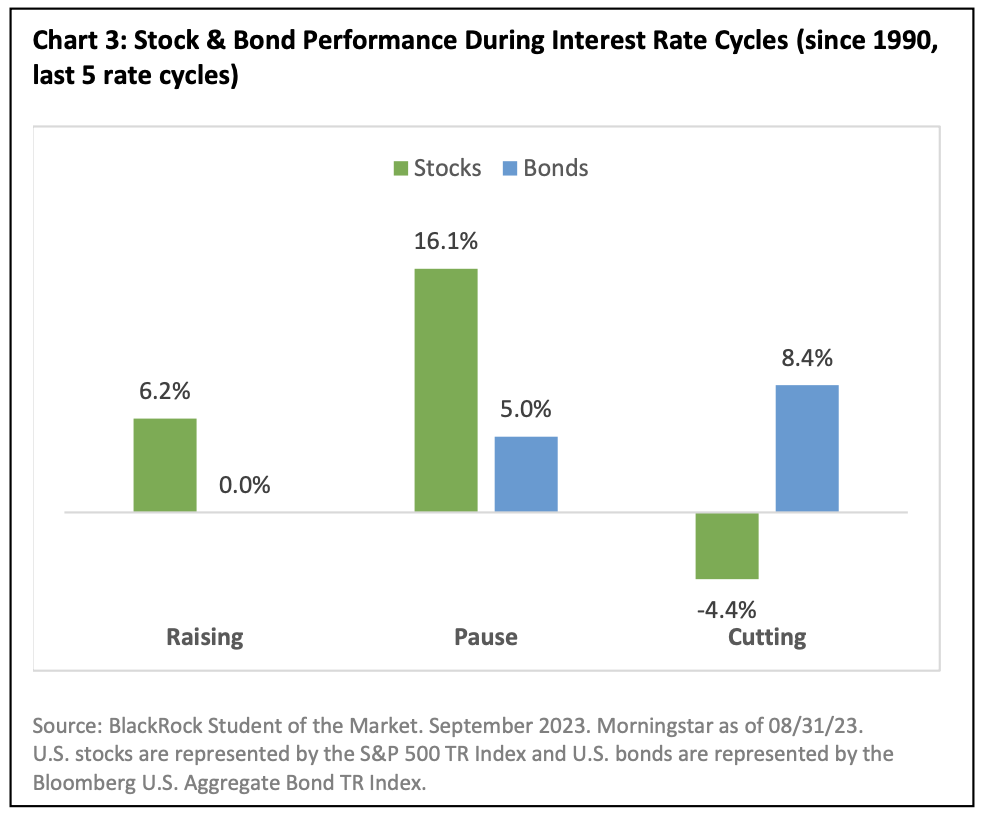

As a result, for those investors with an allocation to bonds in their accounts, we continue to incrementally increase the weight to this asset class. In most instances, we are sourcing the additional investment from cash reserves. For stocks, we continue to evaluate the positions held in relation to investment quality. While quality includes many variables, one that we are paying close attention to is debt levels. In this environment, we continue to minimize exposure to companies that are cyclical in nature carrying risks to growth along with exposure to high levels of debt. Chart 3 below emphasizes stock and bond performance during times of varying interest rate cycles. Important to note is the data in the chart includes averages over the previous five rate cycles. The aggressive rate policy experienced the last 18 months has varied from the gradual rising rate cycles previously.

Summary

While much of this update deals with complex and somewhat less than rosy news for the near-term, we maintain our optimistic view that economies and markets trend up over time. We intend to focus more attention to this during our year-end review and outlook. We invite you all to reach out to your investment professional with any questions as it relates to your personal needs. Finally, as we celebrate our 15th year in serving our clients, we remind you to continue your pursuit of the Freedom to live an inspired lifeTM.

Investments may fluctuate in value. Investing involves risk including the possible loss of principal. Past performance does not guarantee future results.

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

1Index returns are for illustrative purposes only and do not represent actual performance of any investment. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. The Standard & Poor’s (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization U.S. stocks. The MSCI All Country (AC) World ex U.S. Index tracks global stock market performance that includes developed and emerging markets but excludes the U.S. The Bloomberg U.S. Aggregate Bond Index is a broad-based fixed-income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance

6Index returns provided through Envestnet Tamarac, underlying data provider: Thomson Reuters.