2nd Quarter 2023 Investment Update

Craig McCrory, CFA – Partner, Chief Investment Officer

Overview

- We are likely nearing the end of the current interest rate hiking cycle from the Federal Reserve. The effects of a tight monetary policy will continue to impact the economy and financial markets in the months ahead. We believe that the ‘rolling recession’ will continue across the economy.

- The national debt ceiling in the US is set to be reached this summer. If an agreement is not reached before hitting the limit, financial markets will most likely react negatively in the short-term.

- Cash savings rates are at levels not seen since before the Global Financial Crisis (GFC) began in 2007. Use this time to evaluate your cash management strategy for near-term and lifestyle expense needs.

Following the recent quarter-point increase in the federal funds rate to 5%, we are likely near the end of the current interest rate hiking cycle. At the current level and speed of interest rate increases, monetary policy has entered restrictive territory. It is important to note that the cause of recessions in the last 50 years has been tight monetary policy. While the absolute peak of interest rates is yet to be determined, the impact of interest rate increases has been visible in the economy, most notably in real estate and the recent banking turmoil. In addition, after adjusting for seasonality1, sales per share of companies in the S&P 500 fell quarter-over-quarter for the first time since the global pandemic. The Federal Reserve and other central banks around the developed world continue to raise rates in an attempt to lower inflation and slow the economy. With the additional mandate of maximum employment, unemployment is suggested as the next step of economic contraction.

The current cycle of rising interest rates continues to be the fastest on record in the last 50 years. The Fed appears to be keenly aware of the struggles imposed during the 1970’s as it relates to the costs of decreasing interest rates too soon (prolonged inflation along with low growth, also known as stagflation). As a result, our view continues that while the pace of rate increases may slow or cease in the near future, interest rates near current levels will remain for a period of time. The duration of Fed Funds rates above 5% will depend on when we experience sufficient economic contraction in the labor market to drive the need to lower interest rates. The financial sector will increase scrutiny on their lending standards as a byproduct of the recent banking crisis. This action has a similar impact on tightening monetary policy without the Fed having to raise rates.

Since the start of lockdowns due to the global pandemic, we have experienced what we call a ‘rolling recession’. Unlike previous recessions, where the broad economy slows in the aggregate, the episode we are currently experiencing started in March 2020 with a severe recession in the service industries such as entertainment, travel, and leisure. Over time and as the world began to reopen, service industries came out of recession. They were followed with technology and now real estate. The economy continues to work through the lingering economic effects of the pandemic. If the Fed takes its foot off the brakes too soon and lowers rates, the markets will view this as favorable for stocks. Our fear is the outcome of this action would be temporary and likely produce future and more severe economic pain as it could be viewed as deferring the need to correct inflationary imbalances to a future date. That said, we are finding opportunities in stocks for patient investors.

While on the topic of risk, the debt ceiling decision in the US continues to be on our radar. The federal government will likely reach the debt ceiling sometime in late June or early July. As happened in 2011, a split Congress was initially unable to a reach consensus on the country’s debt. As a result, the S&P 500 fell 16% in five weeks, and the US credit rating was downgraded for the first time in history2. While efforts are underway to reach an agreement before the default date, this remains a situation we are monitoring closely.

As discussed in our Annual Economic & Market Outlook in January, bonds are back. Investors with an investment objective that includes an allocation to bonds will continue to see shifts in our allocation. Those adjustments include increasing weight to the asset class and extending the underlying holdings’ maturity and duration (sensitivity of a bond’s price to changes in interest rates) of the underlying holdings. These actions directly result from our belief that interest rate yields have seen or are near the peak. In addition to stepping further out on the interest rate yield curve from our previous short-term bias during the last low and rising interest rate environment, we are reintroducing emerging market and high-yield debt to the bond allocation. Both of these are in response to the rapidly changing economic landscape.

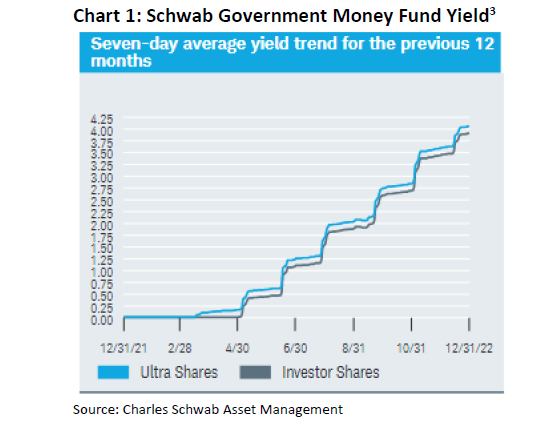

Along with bonds being back, the same can be said for cash. Cash remains essential to an effective overall investment strategy, especially in terms of covering short-term needs and lifestyle expenses. The interest earned is worth noting for the first time in several years. As can be seen in the image below, shares of the Charles Schwab Government

Money Fund (Investor Shares: SNVXX | Ultra Shares: SGUXX) are yielding north of 4%. As of this writing, investor shares for purchases of less than $1 million have a 7-day yield of 4.4%3.

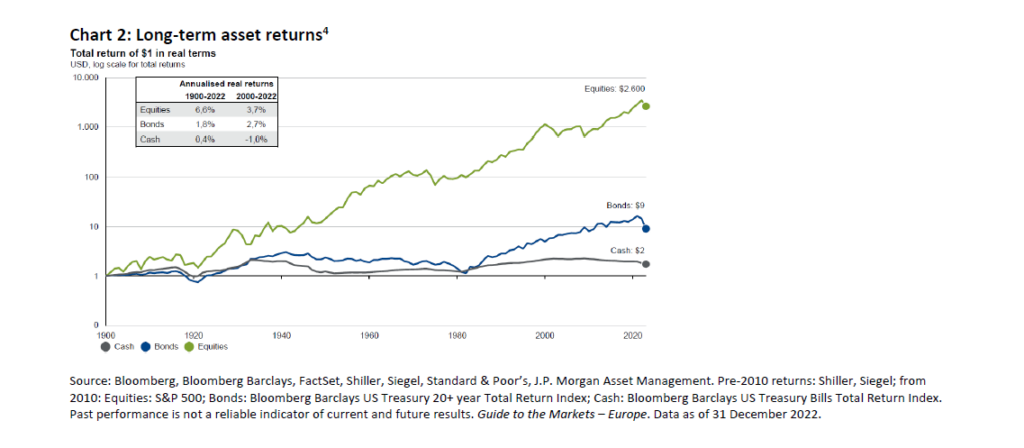

As exciting as it is to see yields on money markets at this level, it is essential to maintain the perspective that historically cash savings rates (saving accounts, money markets, CDs) are not effective at keeping up with inflation and, as a result, reduce your purchasing power over time4 For conservative investors and savers, it is crucial to identify the correct asset mix, including cash, bonds and stocks. While it is comforting to have cash earning interest income, it is important not to be complacent with cash savings rates as your primary long-term investment tool.

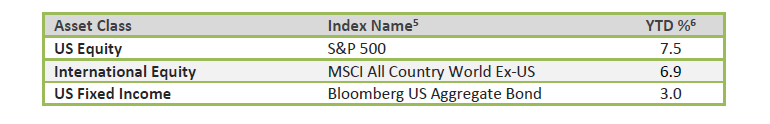

Year-to-date index performance through March 31, 2023:

Investments may fluctuate in value. Investing involves risk including the possible loss of principal. Past performance does not guarantee future

results.

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

1.) The Bank Credit Analyst, BCA Research, March 2023.

2.) Debt ceiling drama will likely rattle markets. Michael Townsend, Charles Schwab Asset Management RIA Washington Watch, March 17,2023.

3.) Charles Schwab Asset Management: https://www.schwabassetmanagement.com/resource/snvxx-sguxx-fact-sheet

4.) J.P. Morgan Guide to the Markets, December 31, 2022

5.) Index returns are for illustrative purposes only and do not represent actual performance of any investment. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. The Standard &

Poor’s (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization U.S. stocks. The MSCI All Country (AC) World ex U.S. Index tracks global stock market performance that includes developed and emerging markets but excludes the U.S. The Bloomberg U.S. Aggregate Bond

Index is a broad-based fixed-income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance

6.)Index returns provided through Envestnet Tamarac, underlying data provider: Thomson Reuters.