Overview

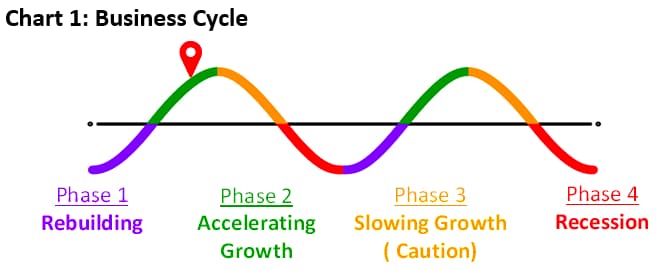

- Business cycle continuing through Phase 2 – Accelerating Growth

- GDP trending towards pre-pandemic levels

- Inflation data suggests we are in an elevated temporary catch-up period before returning to normalized levels partly due to timing vs. one year ago.

- Recession probability remains low. Future performance results are heavily based on corporate earnings.

The reopening of the global economy continues to strengthen given progress in managing the pandemic. Steps toward economic recovery thus far have been uneven across regions with economic and financial market performance reflecting the various future paths to recovery. With the backdrop of strong financial market performance through the first half of the year, we maintain our opinion of the likelihood of returning to recession a low probability. Continued economic strength supports the stock market so long as corporate earnings continue to increase and interest rates are contained.

Following last year’s reset, the economy continues its return to pre-pandemic levels. In updated Chart 1 below, the business cycle has continued accelerating during the first half of the year and is likely to continue in Phase 2 growth through year-end.

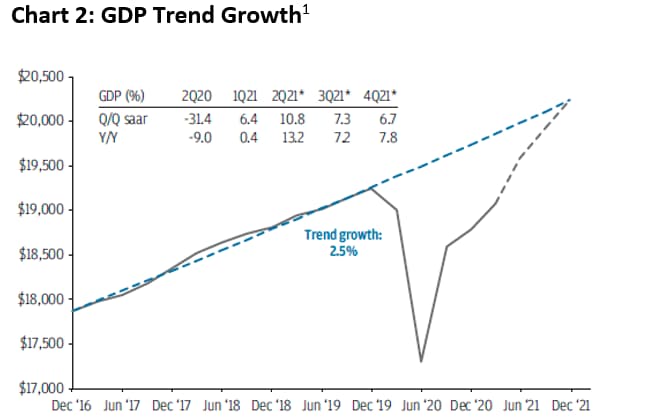

The pace of the economic recovery in the US can also be seen by reviewing productivity growth. Gross domestic product (GDP), a measure of the country’s economic output through the production of goods and services, reflects the likely return to normalized trend growth within the next 12 months. The pace of growth depends on a variety of factors including the continued reopening as well as progress towards satisfying the supply/demand imbalance for many goods and services. While durable goods remain in high demand, services are key to further economic expansion. Many discretionary service providers took the brunt of the impact during the pandemic lockdowns and are now returning to partial and full capacity.

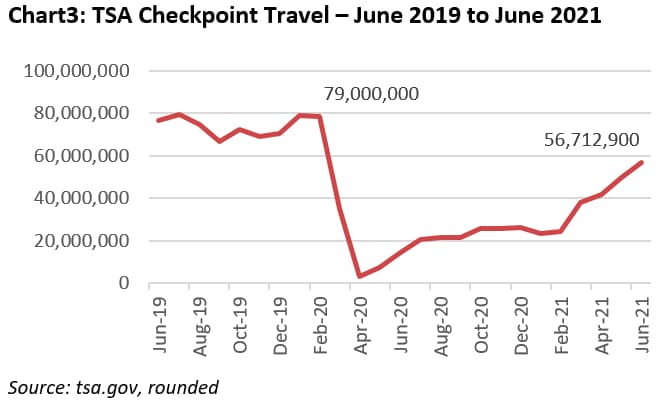

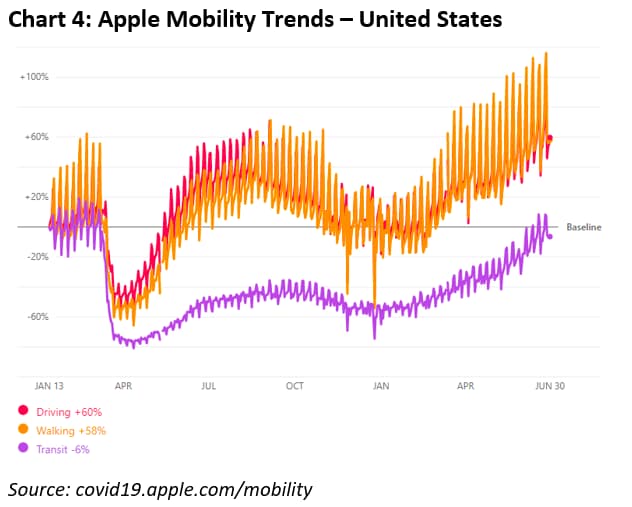

In the same spirit, the following two charts are updates from our 4th Quarter 2020 Investment Update reflecting the progress towards a return to pre-pandemic activities. As you can see and may have personally experienced, air travel has increased, yet remains nearly 30% below peak levels. Picking up the slack has been other forms of more localized travel. In addition, transit has finally returned to near average levels after spending much of the previous year severely underutilized.

A topic not reflected in the charts above are price increases for everyday consumer goods and services. While price inflation has increased, causing fears of elevated levels of inflation, our opinion is that the price increases are a necessary evil during a rebuilding period. While prices are likely not set to decrease in the future, the pace of price increases will likely slow to a normalized level. Supporting the eventual slowdown in inflation are employment levels, including the elevated under-employment rate and decreasing labor force participation and employment-to-population ratios. The current levels of employment measures have a deflationary effect on consumer prices in time periods beyond the short-run.

Year-to-date index performance through June 30, 2021:

| Asset Class | Index Name2 | YTD %3 |

|---|---|---|

| US Equity – Large Cap | S&P 500 | 15.3 |

| US Equity – Small/Mid Cap | Russell 2500 | 17.0 |

| International Equity – Large Cap | MSCI All Country World Ex-US | 9.2 |

| US Fixed Income | Bloomberg Barclays US Aggregate Bond | (1.6) |

| Alternatives – Real Estate | MSCI US REIT | 21.8 |

Pulling these diverse pieces together, our view is that the probability of returning to recession is low. There remains the possibility of a near-term correction which is overdue based on historical norms. A key driver of continued stock market bullishness will be the ability of corporate earnings to sustain their trend of excellent performance. We maintain our preference of stocks over bonds in the current environment.

With the disclosure that each client’s situation is distinct, we have generally been realizing gains on some appreciated holdings in accounts. Our focus continues to be on the balanced mix of stocks and bonds in accounts based on investment objective and sizing of individual position weights. These efforts have resulted in two general themes:

- Repositioning within the accounts to areas we believe will prosper during the post-pandemic period; and

- An increase in realized gains in accounts potentially increasing your tax liability. While difficult to predict, we expect personal income tax rates to increase beyond 2021.

Please contact our team with specific questions as it relates to your personal circumstance.

Be safe, healthy, and enjoy the summer.

Investments may fluctuate in value. Investing involves risk including the possible loss of principal. Past performance does not guarantee future results.

(1) J.P. Morgan Asset Management, The Investment Outlook for 2021: A Midyear Review. Billions of chained (2012) dollars, seasonally adjusted at annual rates.

(2) Index returns are for illustrative purposes only and do not represent actual performance of any investment. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index.

(3)Index returns provided through Envestnet Tamarac, underlying data providers: Thomson Reuters except for Russell 2500 which is provided by Russell.