Overview

- Economic growth has slowed as the Federal Reserve and global central banks respond to rising inflation.

- Both stock and bond prices are experiencing one of the worst-performing starts to a year in history. With interest rates rising, bonds are finally re-emerging as an income investment.

- Global stock markets have responded to the risk of stalling the economy. Valuations of US stocks have returned to levels that provide attractive long-term opportunities. Short-term risks remain however.

- We revisit the three types of bear markets and discuss the benefits of a long-term approach to investing.

Imbalances in the economy continue to pressure global financial markets. The first half of the year has been met with challenges resulting from the continued pandemic recovery (supply chain and staffing issues) along with the lingering conflict in the Ukraine. The Federal Reserve, along with central banks worldwide, is facing the challenge of managing an economy that in some sectors likely overheated (large company technology) along with others that are still emerging from pandemic restrictions (consumer and business travel). Inflation has remained persistent, most notably in goods, while service sectors struggle to set their pricing based on increases in input costs. In 2021, initial data reflected demand side inflation. As the recovery continues, supply factors are now visible.

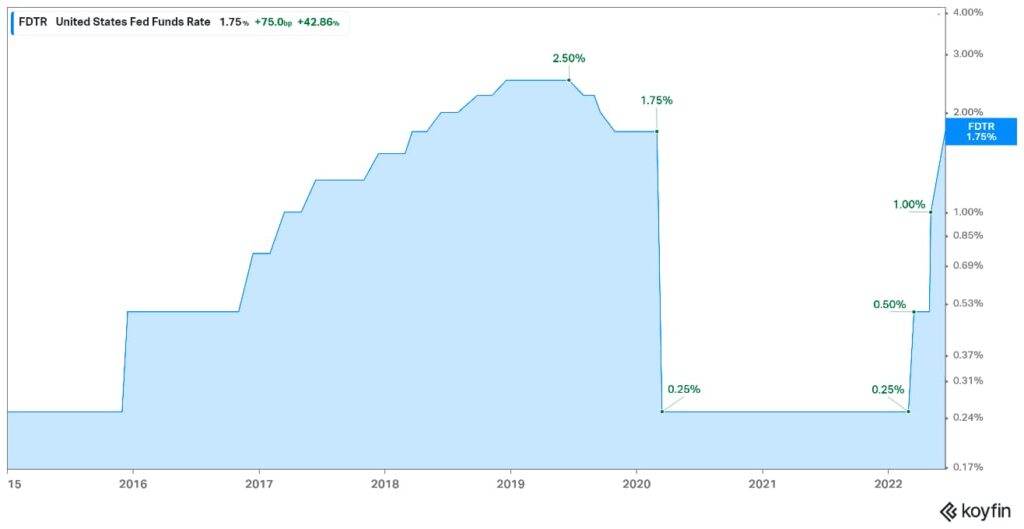

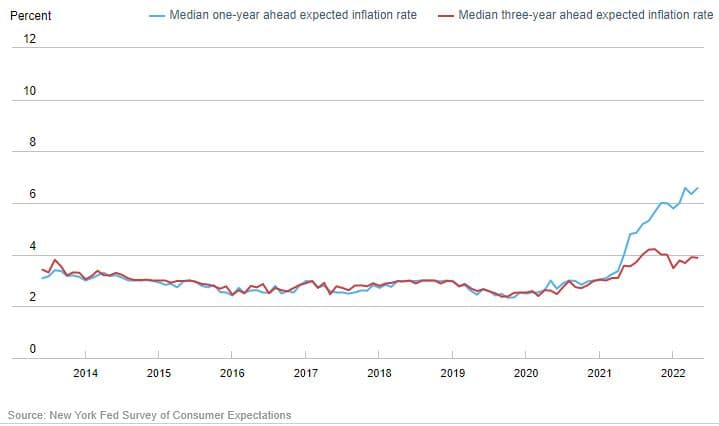

As displayed in Chart 1 below, the Federal Reserve aggressively increased the base Federal Funds Rate by 0.75% to 1.75% last month. The rate increase is the largest one-time increase since November 1994. As we all know, higher prices continue to be visible in areas such as gasoline and food. This happened due to both a decrease in global production over the last few years and the uncertainty brought on by the conflict in the Ukraine. Chart 2 reflects inflation expectations for both 1-year and 3-years forward and show expectations for inflation waning through time.

Financial markets do not like uncertainty. As a result of the continued economic recovery, global conflict, and interest rate policy, markets have responded across the investable asset classes of stocks and bonds. A balanced portfolio with a mix of stocks and bonds has experienced a larger pullback in the first half of this year than during the pandemic-led recession in 2020. With bonds having one of the worst starts of any year going back through time, we note that it is not customary for both stocks and bonds to pullback in tandem. As you have heard from us previously over the last few years, we have favored stocks over bonds based on economic growth and a low interest rate environment. During this time, we have actively reduced our exposure to bonds as well as shortened the average maturity. As interest rates begin to rise, bonds are starting to look more attractive as a source of income. Specifically, we recently increased our exposure in taxable accounts to municipal bonds as the interest income after adjusting for taxes (tax-equivalent yield) provides higher net yields versus corporate bonds. Through this rebalance, we also reduced our average maturity even further.

Specific to stocks, uncertainty remains in the form of a too aggressive interest rate response (hawkish) resulting in a decline in corporate earnings. While the risk of recession has increased in the last several weeks, current indicators suggest that economic growth will prevent a technical dip into recession in 2022. That will be a close call however. Unfortunately, other risks remain including manufacturing disruptions as China recently reinstated lockdown measures as part of their ‘Zero COVID’ policy. In addition, Russia’s actions in the Ukraine and the global response continue to inject further market volatility. As seen in Chart 3, the forward Price-to-Earnings ratio (P/E) for the US S&P 500 has fallen below its average of the last 20-years. While the exact timing of a bottom is difficult to predict, we are of the strong view that the next few months will provide excellent buying opportunities for long-term investors.

While we navigate through the current market environment, we wanted to revisit the topic of bear markets last discussed in 2020. A bear market is traditionally defined as a period where stock prices fall 20% from their recent high.

There are three types of bear markets:

- Event-Driven: Caused by a current event shock such as a pandemic or war.

- Cyclical: Part of the economic cycle including a rise in interest rates or declines in corporate profitability.

- Structural: Financial bubbles.

In the same order as above, duration and impact vary. On average, event-driven are shorter in duration and result in less of a decline from peak to trough1. 2020 was an event-driven bear market. In our current view of 2022, we are experiencing a combination of an event-driven and cyclical bear market. While proving to be longer lasting than the 2020 correction, we are not of the mind that the characteristics of the current market response are purely cyclical.

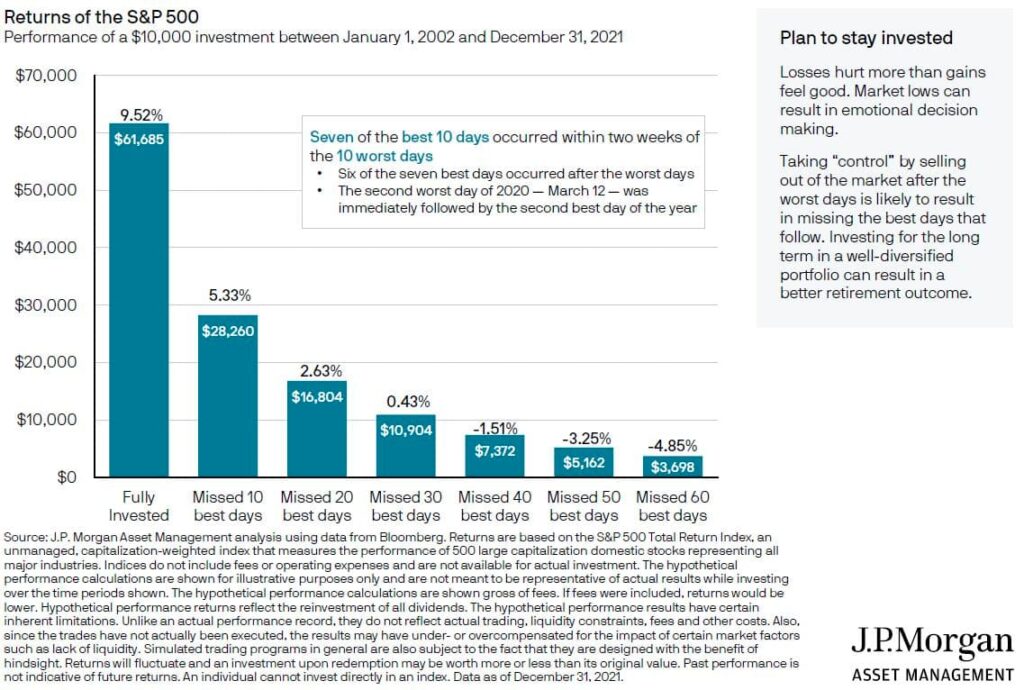

As reflected in Chart 4 below, periods of market turbulence often, and understandably, evoke an emotional response. We know from history that this response is frequently in the opposite direction of what is most beneficial to our long-term success as investors. While we often talk about the benefits of staying invested when times are good, equally important is to stay disciplined when challenging moments like this arrive. Maintaining balance and perspective during difficult times is especially critical for investment success. Communicating any personal updates or cash needs with your financial advisor in a timely manner is also paramount to successfully navigating these periods of stress.

In summary, uncertainty remains. Being forward looking, financial markets are likely to experience continued meaningful movement (in both directions) as we navigate through the summer months and into the mid-term elections. As we discussed in our January Market Outlook, we anticipate global stock markets to have a productive conclusion to the year as visibility becomes clearer on the current events that have produced a headwind to start the year. Although each client’s situation and portfolio are unique, in general throughout 2022, we have kept higher than normal cash, shortened maturities in bonds, and introduced more tax-exempt municipals where they make sense. We continue to look to upgrade the stock portfolios with an eye toward long-term value, risk management and sector opportunities. Despite the weak start to the year, we sincerely hope you are able to look beyond the current news and find a way to enjoy a pleasant summer.

Year-to-date index performance through June 30, 2022:

| Asset Class | Index Name2 | YTD %3 |

|---|---|---|

| US Equity | S&P 500 | (20.0) |

| International Equity | MSCI All Country World Ex-US | (18.4) |

| US Fixed Income | Bloomberg Barclays US Aggregate Bond | (10.4) |

Investments may fluctuate in value. Investing involves risk including the possible loss of principal. Past performance does not guarantee future results.

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

(1) Bear Essentials: a guide to navigating a bear market, Goldman Sachs, March 9, 2020. Peter Oppenheimer, Sharon Bell, CFA, Lilia Peytavin, Guillaume Jaisson.

(2) Index returns are for illustrative purposes only and do not represent actual performance of any investment. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index.

(3) Index returns provided through Envestnet Tamarac, underlying data provider: Thomson Reuters.

The Standard & Poor’s (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization U.S. stocks.

The MSCI All Country (AC) World ex U.S. Index tracks global stock market performance that includes developed and emerging markets but excludes the U.S.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based fixed-income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance.