Overview

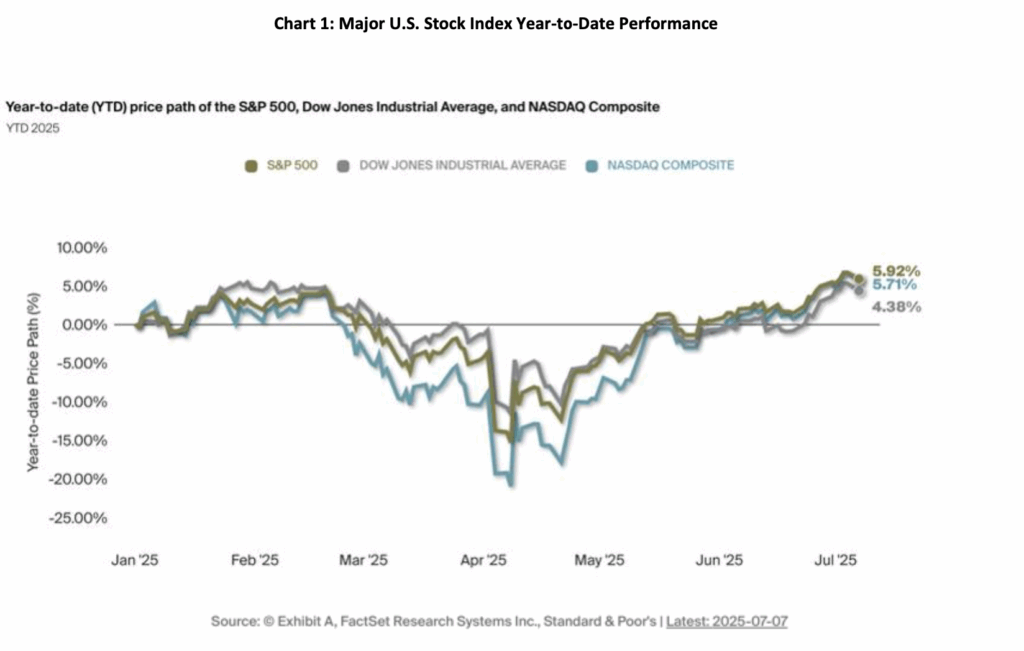

- The second quarter of 2025 was a volatile one. U.S. stock markets saw a decline of almost 20% only to recover all of their losses and then some by the end of the quarter.

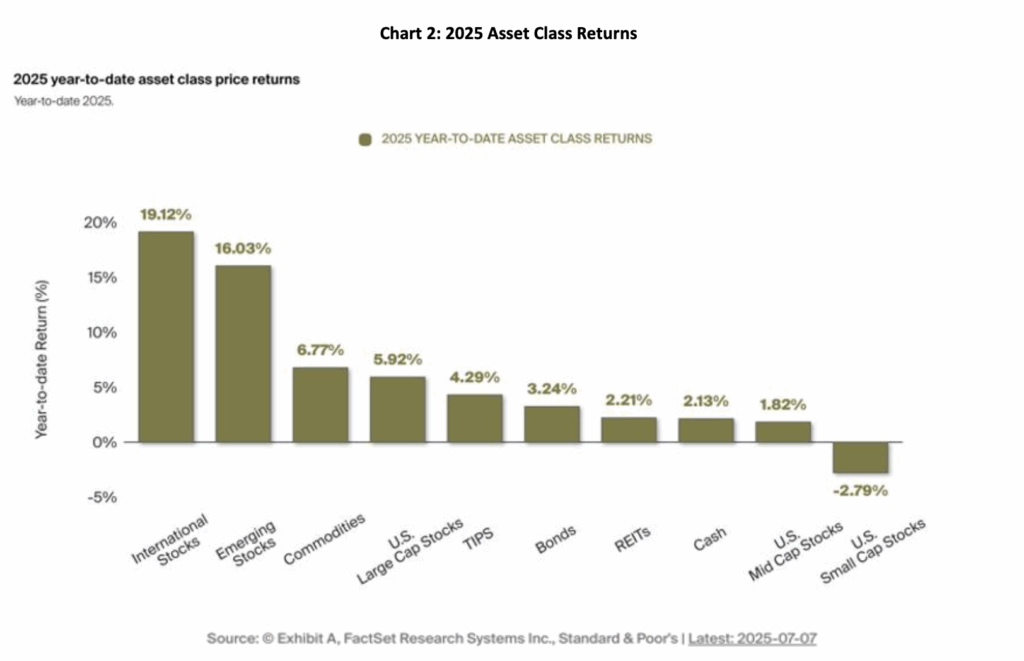

- Diversification benefited portfolios in the first half of the year with bonds providing ballast when stock markets were volatile and international stocks significantly outperforming after decades of underperformance.

- We believe the combination of a slowing but still growing economy, potentially falling interest rates, and the potential for increasing clarity on tax and trade policy make for a positive backdrop for both stock and bond investors.

Markets have been on a bit of a roller coaster to start 2025. At one point in April, U.S. markets were down nearly 20%, and many individual companies and sectors experienced significantly larger drawdowns. Despite this large pullback, the U.S. stock market made a swift recovery, and at the moment, U.S. stocks are up around 5% for the year. We believe that the key drivers of volatility in the first half of 2025 were announcements regarding U.S. trade policy, signs of slowing economic growth in the U.S., and a stock market that entered the year at elevated valuations. Broadly speaking, we are generally optimistic about the current state of the markets, and here are a few key areas that our investment team is focusing on as we enter the second half of the year.

Diversification is benefitting portfolios again:

The benefits of diversification have been on display so far in 2025. International stocks are having a moment, significantly outperforming U.S. stocks after a decade and a half of underperformance. Additionally, bonds resumed their role of providing defense in volatile equity markets when stocks fell during April and early May. At the current level of interest rates, we believe bonds are likely to offer higher returns over the next five years than they have over the last five and are likely to help buffer portfolios when stock markets get choppy.

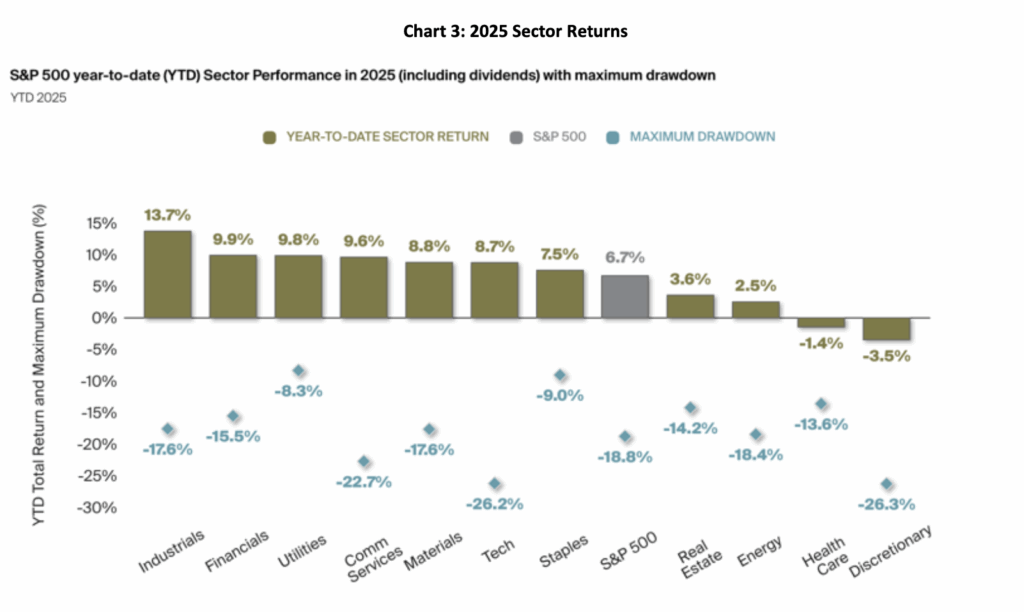

We are also seeing the benefits of diversification when examining the performance of the U.S. stock market more closely. A few large companies (mostly technology companies) powered most of the market’s gains over the last decade and a half. The first half of this year has bucked that trend. Technology companies have not led the way, and the market is being led by sectors that have lagged over the last several years, such as industrials, financials, and utilities. In our view, this trend is likely to continue. We believe that this environment of a broadening market warrants a well-diversified portfolio and should present opportunities for active stock pickers.

The U.S. economy is slowing but still looks healthy:

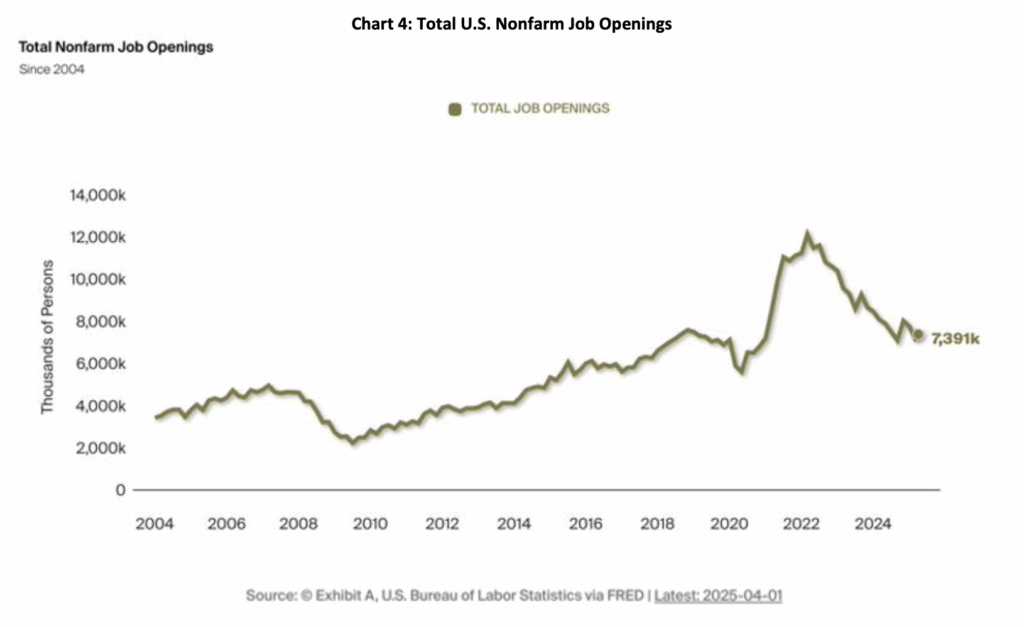

The U.S. economy has shown incredible resilience in the years following the Covid-19 pandemic. The primary driver of this has been the health of the U.S. consumer. Over that time, U.S. consumers have had very healthy balance sheets, and they have benefited from a strong labor market. This combination led to robust consumer spending and solid U.S. growth. Today, while the U.S. economy still appears to be in a healthy position, there are some data points that suggest things are slowing. Chart 4 illustrates one of them, total U.S. nonfarm job openings. The total level of job openings is healthy at just over 7 million open jobs, which is about equal to the number of unemployed workers. This implies that the labor market is well balanced. That said, the trend in job openings is clearly down, indicating that it is getting harder and harder for unemployed workers to find a new job. Consumer spending makes up about 70% of the U.S. economy and there is plenty of research that shows consumers tend to spend more when jobs are plentiful and they feel secure in the jobs they have. It is this reason why a weaker labor market is worth paying attention to. It could lead to lower economic growth. We certainly don’t believe this is cause for panic, but it’s worth watching. The overall economy still looks like it is in a healthy position, but we are seeing things slowing down and we believe that means investors should maintain a well-diversified and higher quality portfolio.

Tax and trade policies will also impact economic growth in the second half of 2025. The recent tax bill is wide-ranging and will have a large variety of impacts on the economy. Most economists project that the legislation will increase the federal debt and deficits. Debt and deficits are a concern for us in the longer term, but we do not believe they are likely to impact the short-term investment landscape. We also believe that the bill’s incentives for capital expenditures will be a positive for U.S. economic growth in the near term. Trade policy will also have a significant impact on the economy and financial markets. There is still a lot to be worked out on the trade front, and tariffs are likely to negatively impact business margins and potentially raise prices for consumers. That said, in our view, once there is some clarity on the level of tariffs, companies will adjust, and ultimately, we believe the economy will power through.

U.S. interest rates are likely to start coming down:

As of this writing, bond markets are pricing in two rate cuts by the Federal Reserve this year. The Fed has two mandated goals, stable prices (inflation of around 2%) and full employment (unemployment at about 4-5%). They are reasonably close to both goals at the moment, but the path forward could get tricky. As mentioned above, the labor market is healthy but softening. In addition, inflation has been more persistent than the Fed would like. Furthermore, tariff policy poses a risk that inflation ticks up. In our view, this is why the Fed has been slow to cut rates. We believe the cooling labor market may force their hand in the back half of the year and that the likely direction of U.S. interest rates over the next 12 months is downward. This should help consumer confidence, particularly in the housing sector. A growing economy, even if it is a slower growing one, and falling interest rates have historically been a positive backdrop for both stocks and bonds.

In closing:

The second quarter of 2025 was incredibly volatile, but markets ended up in positive territory. Uncertainty is an ever- present part of investing, but the current moment feels more uncertain than usual. We believe that as clarity emerges in areas such as trade and fiscal policy, as well as the direction of U.S. interest rates, sentiment among businesses and consumers should rise. This should help boost economic activity in an economy that appears to be in a “wait-and-see” mode at the moment. We also believe that investors will continue to benefit from maintaining a well-diversified portfolio. In our view, the broadening of stock market performance is likely to continue, and there will be numerous opportunities outside of just a few U.S. technology companies. We also believe that the outlook for bonds has meaningfully brightened given the current level of interest rates.

There are certainly risks out there, but our view is broadly a positive one for both stock and bond markets. As always, our message is to focus on your long-term goals, maintain a well-balanced portfolio, and don’t hesitate to contact your financial professional if you’d like to discuss anything further.

Index performance through June 30, 2025:

Investments may fluctuate in value. Investing involves risk including the possible loss of principal. Past performance does not guarantee future results.

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

2 Index returns are for illustrative purposes only and do not represent actual performance of any investment. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. The Standard & Poor’s (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization U.S. stocks. The MSCI All Country (AC) World ex U.S. Index tracks global stock market performance that includes developed and emerging markets but excludes the U.S. The Bloomberg U.S. Aggregate Bond Index is a broad-based fixed-income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance

4 Index returns provided through Envestnet Tamarac, underlying data provider: Thomson Reuters.