Historically, the most common way to structure retirement portfolios was to focus primarily on income generation. This strategy is generally referred to as the income approach. The objective of the income approach is to generate enough annual income from a portfolio, mainly from bond interest and stock dividends, to cover most or all of a retiree’s annual living expenses.

For many years, the income approach was a highly feasible strategy for designing retirement portfolios. This is because for several decades prior to the early 2000s, interest rates were high enough to allow most investors to comfortably live off the income generated by a diversified portfolio. During the 1980s, the average yield on a 50% stock/50% bond portfolio was in the range of 6% to 10% and, during the 1990s, it was in the range of 4% to 6%(1). A common annual spending rate for individuals during retirement is an amount equivalent to about 4% of their accumulated savings(2). Therefore, at yields of 4% to 6% and above, most investors would be able to comfortably fund their living expenses during retirement simply by relying on the income generated by their portfolio.

Structuring retirement portfolios has become more challenging as yields in the market have declined significantly compared to historical averages. Currently, the yield of the 10-year US Treasury bond is around 2.8% while the dividend yield of the S&P 500 stock index is around 2.0%. This means that the average yield of a 50% stock/50% bond portfolio today is in the neighborhood of 2.5%. At current yields, most investors find it difficult to fund their annual living expenses in retirement solely from the income generated by a well-diversified portfolio.

The income approach as a concept remains popular today, in large part because of how well it worked historically. Many investors entering retirement continue to gravitate towards this approach. However, in trying to implement the income approach in today’s market environment, many retirees may be doing considerable harm to their investment portfolio.

The main risk in trying to implement the income approach in today’s market environment is that investors will almost inevitably be forced to “reach for yield” to generate their desired income return. In trying to generate an annual income return of 4% or more, investors will likely need to invest a substantial part of their portfolio in higher-risk areas of the market. These might include: non-investment grade bonds (also called high yield or junk bonds), high dividend yield stocks and high yield alternative investments, such as energy master limited partnerships (MLPs). While a moderate allocation to these segments of the market may make sense in a well-diversified portfolio, a large allocation will lead to an excessive amount of risk. In addition, the portfolio is likely to become overly concentrated in certain areas of the market, which can lead to poor investment outcomes over the long run.

To see how reaching for yield can lead to excessive risk, let’s consider the case of US non-investment grade bonds. Currently, the yield on US non-investment grade bonds is in the neighborhood of 5%. For a retiree looking to generate an income return of 4% or more on his or her portfolio, investing aggressively in US high yield bonds is very tempting. Unfortunately, a very high allocation to these types of bonds would dramatically increase the risk of the retiree’s portfolio and would expose the portfolio to considerable losses during periods of major financial stress.

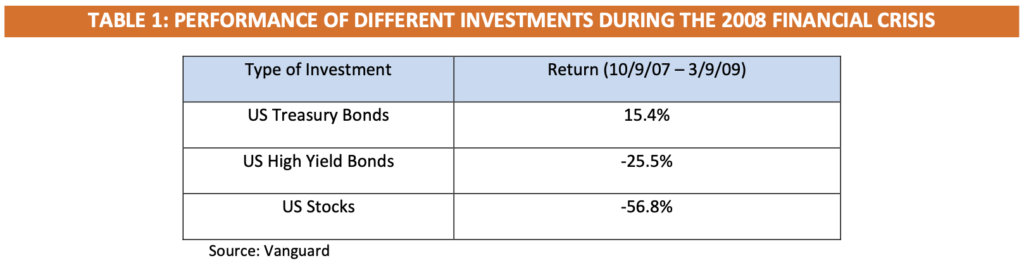

For a perspective on this, we need to look no further than the 2008 financial crisis. As can be seen in Table 1 below, from October 9, 2007 to March 9, 2009, US high yield bonds declined in value by nearly 26%. In contrast, US Treasury bonds increased in value by over 15%3. Clearly, during this heightened period of financial stress, US high yield bonds failed to provide the safety and diversification benefits that most investors seek from their fixed income investments. One might even argue that their performance was more “equity-like” than “bond-like.”

Reaching for yield can also lead to excessive concentration in a portfolio. For starters, there are relatively few areas of the market today that offer yields well above 4%. Therefore, an investment strategy that tries to maximize income may become highly concentrated in these areas. Beyond this, some of the areas of the market with high yields are themselves concentrated in certain industries or sectors, which may create a further lack of diversification in the portfolio. High dividend yield stocks are a good example of this. A large percentage of stocks with high dividend yields are concentrated in just a few industry sectors, most notably consumer staples, utilities and telecommunications. Therefore, an excessive allocation to high dividend yield stocks would likely result in an unbalanced portfolio with not enough exposure to higher growth sectors of the market, such as technology or consumer discretionary. Not having enough growth exposure in a portfolio can be very costly when growth investments are doing well, as has been the case in recent years.

Instead of trying to implement the income approach in today’s market environment, we believe a better alternative is to adopt a different strategy: the total return approach. This approach focuses not just on income, but on both sources of return from a portfolio: income and capital gains. With a total return approach, investments in a portfolio are not selected based solely on their yield; instead, investments are selected based on their total return (interest or dividends plus capital appreciation) potential. The underlying idea behind the total return approach is that it should not make a major difference from an investment standpoint whether returns are delivered as income or capital gains4.

Most pre-retirement portfolios are constructed with a total return approach in mind. In today’s market environment, we believe it should also be the preferred approach for retirement portfolios.

The first thing to note about the total return approach is that it is similar to the income approach up to a certain point. Specifically, using the total return approach, investors also spend the income of the portfolio to meet their living expenses during retirement. However, under the total return approach, if the income of the existing portfolio is not sufficient to cover the retiree’s living expenses, then the spending gap is met by selling assets from the portfolio5.

There are numerous advantages of using the total return approach over the income approach for constructing retirement portfolios. A 2016 study by Vanguard Research identified the following four key advantages: better diversification, more control over portfolio withdrawals, better tax efficiency and the potential of increasing a portfolio’s longevity6. We will briefly touch on each of these.

Better Diversification. The total return approach is well-suited to maintaining a properly diversified investment portfolio at all times. One of the main reasons for this is that there is no explicit incentive to reach for yield, which as we have seen can easily lead to an unbalanced portfolio. Having a well-diversified portfolio is very important because it significantly reduces the investment risks faced by a retiree and is likely to lead to better investment results over the long-term.

More Control over Portfolio Withdrawals. A key advantage of using the total return approach is that it allows retirees to have much more control over the size and timing of portfolio withdrawals. Under the income approach, the yield of the portfolio is the primary driver of spending and, hence, withdrawal decisions. However, the total return approach provides much more flexibility, allowing retirees to implement flexible spending strategies dictated by their cash flow needs at different points in time (and market cycles) during their retirement years.

Better Tax Efficiency. Another important advantage of the total return approach is that it provides investors that own taxable investments with a more tax-efficient portfolio. This is primarily because of the more favorable tax treatment for capital gains compared to dividend and interest income. In the US, long-term capital gains are currently taxed at a maximum rate of 20% (plus the Obamacare surcharge of 3.8% for high income earners). However, dividend and interest income are normally taxed at ordinary income taxes rates, which can be as high as 35% to 37% (marginal tax rates) in the highest tax brackets.

Potential of Increasing a Portfolio’s Longevity. A final advantage of the total return approach is that it has the potential of increasing the longevity of a retiree’s portfolio. This is primarily the result of minimizing the impact of taxes as well as maintaining more control over portfolio withdrawals. In addition, a portfolio constructed using the total return approach will tend to have greater stock exposure than one constructed using the income approach. Greater stock exposure is also likely to increase the longevity of a portfolio given that stocks historically have generated higher real (i.e. inflation adjusted) returns than bonds over longer periods of time.

In Conclusion

Today’s low yield environment has made constructing retirement portfolios more challenging than it was historically. In the past, many retirees could rely on the income generated by their investment portfolio to fund most or all of their living expenses during retirement. Today this is much more difficult to achieve.

Many individuals entering retirement continue to gravitate towards the income approach. However, implementing this strategy in today’s market environment is likely to lead to excessive risk and suboptimal diversification in investor portfolios. This is likely to lead to poor investment outcomes for retirees over the long-term and could materially increase the risk that a retiree outlives his or her retirement assets.

Instead of reaching for yield in trying to implement the income approach, we believe that a better alternative for investors is to adopt a different strategy: the total return approach. This strategy has several important advantages over the income approach and is the better choice overall for today’s retirement investors7.

ENDNOTES

1 Jaconetti, Colleen; Kinniry, Francis and Christopher Philips. “Total-return investing: an enduring solution for low yields.” Vanguard Research, 2012.

2 An annual spending rate equivalent to 4% of their accumulated savings is a common recommendation for what individuals should spend during their retirement years. However, the appropriate level of spending for each individual will depend on their particular financial and personal circumstances.

3 Jaconetti, Colleen; Kinniry, Francis and Christopher Philips. “Total-return investing: an enduring solution for low yields.” Vanguard Research, 2012.

4 Dimensional Fund Advisors. “Yield vs Total Return.” June 2015.

5 Schlanger, Todd; Jaconetti, Colleen; Westaway, Peter and Ankul Daga. “Total-return investing: an enduring solution for low yields.” Vanguard Research, 2016.

6 Ibid.

7 However, every person’s retirement portfolio needs to be assessed individually to determine the best solution for that particular person.

BIBLIOGRAPHY

Charles Schwab. “Retirement Income Strategies: The Total Return Approach.” September 17, 2015. Dimensional Fund Advisors. “Yield vs Total Return.” June 2015.

Jaconetti, Colleen. “Spending from a Portfolio: Implications of a Total-Return Approach Versus an Income Approach for Taxable Investors.” Vanguard Investment Counseling & Research, 2007.

Jaconetti, Colleen; Kinniry, Francis and Christopher Philips. “Total-return investing: an enduring solution for low yields.” Vanguard Research, 2012.

Schlanger, Todd; Jaconetti, Colleen; Westaway, Peter and Ankul Daga. “Total-return investing: an enduring solution for low yields.” Vanguard Research, 2016.