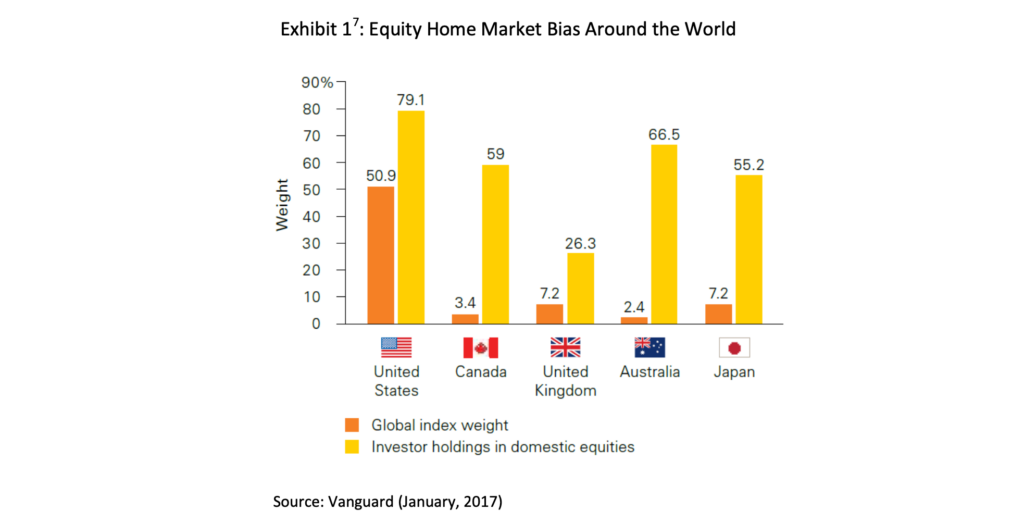

Home bias is the tendency for investors to invest a disproportionate amount of their portfolios in their home country at the expense of international markets. It is a tendency that has been extensively documented(1) and has been shown to occur across many countries around the world (see Exhibit 1(2)). In the United States, for example, investors typically allocate around 20% of their stock portfolios to international investments(3), even though international markets account for nearly 50% of the investable global stock market universe(4). Individual (or retail) investors tend to be significantly more prone to home bias than institutional investors. According to Fidelity Investments, in 2016, US individual investors allocated an average of only 10% to 15% of their equity portfolios to international stocks(5). Beyond this, there are many individual investors who avoid international stocks altogether(6).

There are a variety of reasons why we believe most investors fail to invest sufficiently outside of their home market. For US investors, these reasons include: 1) a preference for investing in what is familiar, 2) optimism regarding returns in the domestic market, 3) lack of knowledge about international markets, 4) concerns about corporate governance standards outside the US, 5) the desire to avoid currency risks and 6) the belief that investing in US multinational companies provides a sufficient degree of international exposure 8. While it is understandable how investors might be susceptible to home bias, this does not mean that investors cannot and should not overcome it. In our view, the key responsibility for us is to help investors better understand the compelling case for international investing.

The Case for International Investing

We believe there are three central reasons that explain why investors should allocate a significant percentage of their portfolio to international markets:

• Superior Diversification

• Potential for Higher Returns

• Vast Investment Opportunities

We will discuss each of these rationales in turn.

Superior Diversification

We believe well-diversified portfolios are an integral part of a sound long-term investment strategy. Diversification (owning different types of investments across and within asset classes) helps investors lower risk and can contribute to more stable investment returns over time. This is important because excessive volatility in investment returns can lead many investors to abandon their long-term investment strategy during challenging periods in the financial markets. In short, diversification helps investors stay the course.

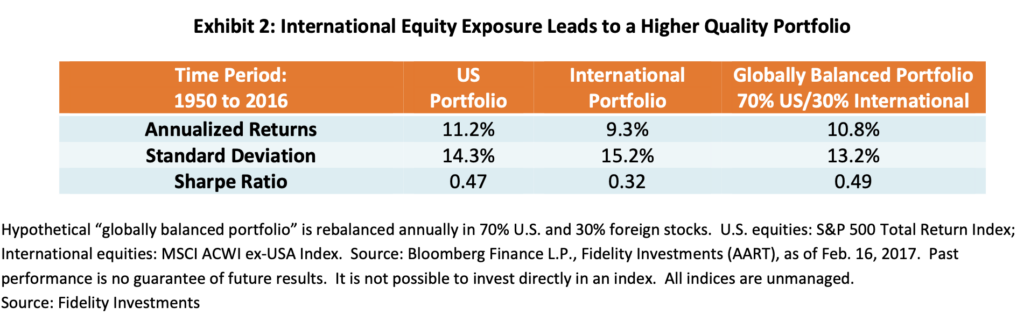

Through our analysis, we believe a meaningful allocation to international investments provides investors with a strong level of diversification and, potentially, a higher quality investment portfolio. It also has the potential to lower risk. This might appear counterintuitive given that international investing is often described as risky. However, in the context of an aggregate portfolio, we believe international investments reduce risk9.

Exhibit 210 illustrates this point. It shows that a hypothetical balanced portfolio consisting of 70% US stocks and 30% international stocks would have generated comparable returns to a 100% US stock portfolio from 1950 to 2016 (10.8% vs. 11.2%). However, the balanced portfolio would have achieved its return with a lower level of risk, as measured by the standard deviation, or volatility, of the portfolio. In finance, the Sharpe ratio is a measure used to assess an investment’s return (reward) to risk relationship, that is, the amount of return an investment produces relative to the risk that it assumes. By implication, investments with a higher Sharpe ratio are superior compared to investments with a lower Sharpe ratio. Exhibit 2 shows that the Sharpe ratio of the hypothetical globally balanced portfolio is higher than that of the US-only investment portfolio. In this sense, the globally balanced portfolio can be said to be superior to the US-only investment portfolio.

Potential for Higher Returns

Historically, US and International stocks have generated similar returns over longer periods of time. For example, from 1970 to 2010, US stocks, as measured by the MSCI USA index, generated an average annual total return of 8.48%. Global stocks, in turn, as measured by the MSCI World Index, generated an average annual total return of 8.68%11.

What is interesting is that history shows distinct and alternating cycles in which either US or international stocks have clearly outperformed the other (see Exhibit 3 below). Typically, these cycles last for around five years or longer. Most recently, US stocks have significantly outperformed international stocks. Specifically, for the five years ending December 2016, US stocks generated an average annual return of about 16% compared to only about 6% for international stocks12.

This cycle of US stock outperformance began to reverse in 2017 as international stocks have outperformed so far this year. If history is any guide, we may now be entering a new cycle in which international stocks will outperform US stocks for the next couple of years.

Valuation is one of the main factors that determine whether international or US stocks are likely to outperform over a particular cycle. If international stocks are attractively valued vs. US stocks (or vice versa), they are likely to outperform over the medium to long-term. Today, the valuations of international stocks are compelling relative to the valuation of US stocks. For example, US stocks are currently trading above 18x forward earnings, which is considerably higher than their 25-year average. In contrast, European and Japanese stocks are currently both trading at about 15x forward earnings. Also, European stocks are currently trading near their 25-year average and Japanese stocks are trading below their 25-year average13. From a valuation standpoint, international stocks appear to be an attractive investment today relative to US stocks. Overall, we believe that international stocks offer the potential for higher returns vs. US stocks looking out over the next few years.

Exhibit 3: Historical Stock Performance of International vs. US Stocks

Vast Investment Opportunities

International markets account for over 95% of the world’s population, over 75% of global GDP and nearly 50% of the global investable stock market universe14. Simply put, US investors who embrace international investing have access to a much broader menu from which to find attractive investment opportunities. While it is true that US S&P 500 companies on average generate about 30% of their sales from international markets15, in our view it is necessary to directly invest in international stocks in order to fully capture the benefits of international equity exposure16.

To provide just one gauge of the size of the international equity opportunity, the MSCI ACWI ex USA index currently consists of 1,858 international stocks. These stocks have an aggregate market capitalization of over US $21 trillion with a median market capitalization of nearly US$5 billion17. It is worth noting that these numbers understate the international equity investment opportunity as MSCI’s indices are generally limited to the more liquid companies in stock markets around the world.

As discussed, international markets already account for nearly 50% of the global investable stock market universe. Yet this percentage is likely to increase substantially over time as many emerging markets become larger parts of the global economy and as their capital markets increase in size and sophistication. Over the long run, it would not be surprising to see international markets account for 60% to 70%, or higher, of the global investable equity market universe. As international markets continue to grow in the future, investors who do not fully embrace international stock investing will be at an increasing disadvantage.

In Conclusion

A meaningful allocation to international stocks provides numerous benefits to investors, including a better diversified portfolio, the potential for higher returns and access to a much broader universe of investment opportunities.

What is the right allocation to international stocks? In our view, investors should allocate at least 25% of their equity portfolio to international holdings (this may vary depending on client circumstances). We believe investors whose portfolios have a meaningful allocation to international equities have the potential of building greater wealth over the long run.

ENDNOTES

1 Please refer to the Bibliography for several studies on this topic.

2 It is interesting to note that many countries outside the US exhibit even more extreme versions of home bias.

3 This estimate of 20% is based on several sources, including Vanguard, BlackRock and Fidelity Investments.

4 As of October 31, 2017, international markets accounted for 48% of the MSCI ACWI (All Country World) stock market index. The United States, in turn, accounted for 52% of the index.

5 Fidelity Investments. “The Case for International Investing.” June 2017.

6 In our own experience at Capital Insight Partners, we have seen many instances where individual investors had no exposure to international stocks prior to becoming clients of our firm.

7 Source: Scott, Brian; Balsamo, James; McShane, Kelly and Christos Tasopoulus. “The global case for strategic asset allocation and an examination of home bias.” Vanguard Research, January 2017.

8 Ibid.

9 This is primarily due to the fact that international stocks are less than perfectly correlated with US stocks. This lower correlation (less than a perfect positive correlation of 1) reduces risk.

10Source: Fidelity Investments, “Dispelling the Myths of International Investing.” 2017.

11 Kleintop, Jeffrey. “The case for a global perspective.” Schwab Center for Financial Research, June 2015.

12 US stock returns are those of the S&P 500 index. International stock returns are those of the MSCI ACWI ex US index. Source: WSJ, Ben Carlson, Thomson Reuters.

13 The sources for the valuation data in this paragraph are: FactSet, Yardeni Research and JPMorgan Asset Management’s “Guide to the Markets.”

14 Sources: JPMorgan, MSCI.

15 Source: FactSet.

16 Typically the performance of stocks is highly correlated to the performance of the underlying stock markets where they are traded.

17 Source: MSCI.

BIBLIOGRAPHY

Cooper, Ian; Sercu, Piet and Rosanne Vanpee. “The Equity Home Bias Puzzle: A Survey.” Foundations and Trends in Finance, vol 7, No. 4 (2012): 289-416.

FactSet. “Earnings Insight.” December 1, 2017.

Fidelity Investments. “Dispelling the Myths of International Investing.” 2017.

Fidelity Investments. “The Case for International Investing.” June 2017.

French, Kenneth R. and James M. Poterba. “Investor Diversification and International Equity Markets.” NBER Working Paper No. 3609 (January 1991).

JP Morgan Asset Management. “Guide to the Markets.” As of September 30, 2017.

Kleintop, Jeffrey. “The case for a global perspective.” Schwab Center for Financial Research, June 2015.

Scott, Brian; Balsamo, James; McShane, Kelly and Christos Tasopoulus. “The global case for strategic asset allocation and an examination of home bias.” Vanguard Research, January 2017.

Tesar, Linda and Ingrid M. Werner. “Home Bias and High Turnover.” Journal of International Money and Finance, Vol. 14, No. 4 (1995): 467-492.

Index Definitions

MSCI ACWI ex USA index: The MSCI ACWI ex-USA index captures large and mid cap representation across 22 of 23 Developed markets (DM) countries (excluding the US) and 24 Emerging Markets (EM) countries. With 1,858 constituents, the index covers approximately 85% of the global equity opportunity set outside the US. Source: MSCI.

MSCI USA Index: The MSCI USA Index is designed to measure the performance of the large and mid cap segments of the US market. With 632 constituents, the index covers approximately 85% of the free-float adjusted market capitalization in the US. Source: MSCI.

MSCI World Index: The MSCI World Index captures large and mid cap representation across 23 Developed Markets (DM) countries. With 1,653 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. Source: MSCI.

S&P 500 Index: The S&P 500 index is widely regarded as the best single gauge of large-cap US equities. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. Source: S&P Dow Jones Indices, a division of S&P Global.